My afternoon train reading:

• The Rise and Inglorious Fall of Myspace (Businessweek)

• A Few Disconnects in CEO Pay (WSJ)

• Euro austerity example Ireland ‘may need second bailout’ (Telegraph) see also Cracks are appearing in Europe’s state-backed lenders (Telegraph)

• Tax policy shocks and the business cycle (MacroMania)

• Walking a Treasury Tightrope (WSJ)

• Schumer And Casey’s Ex-PATRIOT Act: Details Of How They Plan To Get Saverin’s $67M And More (Tech Crunch)

• What Did JPMorgan Execs Know and When Did They Know It? (Pro Publica)

• Smartphone hijacking vulnerability affects AT&T, 47 other carriers (Ars Technica)

• Facebook IPO Goes Nowhere In Exciting Fashion (DealBreaker)

• The Commencement Address That Won’t Be Given (Robert Reich)

What are you reading?

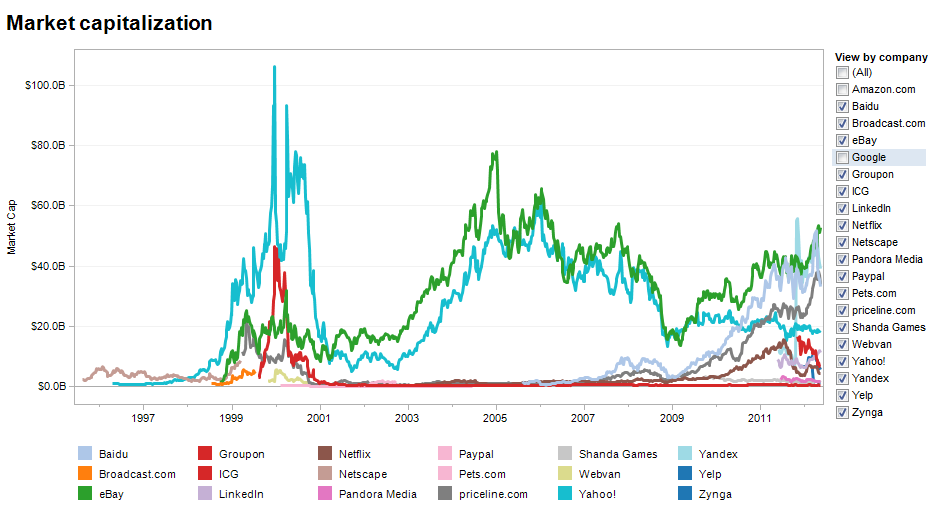

Internet IPO Market Caps

Source: WSJ

What's been said:

Discussions found on the web: