Some longer reads for your Sunday morning:

• Madness in Spain Lingers as Ireland Chases Recovery (Bloomberg)

• How McDonald’s Came Back Bigger Than Ever (NYT Magazine)

• Facebook Hits The Maggot Mile (I ♥ Wall Street)

• Life after Investment Banking (Wall Street Oasis)

• Don’t be this “trader” (Trader Habits)

• Why Zero Tolerance Fails: Walla Walla, WA, tries new approach to school discipline — suspensions drop 85% (Aces Too High)

• Against Chairs (Jacobin Mag)

• Five Reasons Robot Sex Partners Won’t End Human Trafficking (Technology Review)

• Seat of Power: ‘The Passage of Power,’ Robert Caro’s New L.B.J. Book (NYTRB)

• NBC: With Friends Like These (VF)

What are you doing with yourself today?

>

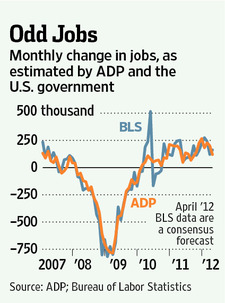

For Job Gauges, Never the Twain Shall Meet

Source: WSJ

What's been said:

Discussions found on the web: