My early morning reads:

• Secular Bull and Bear Markets (Advisor Perspectives)

• Note to CEOs: Most mergers don’t pay (CNN Fortune)

• SEC Keeps Ratings Game Rigged (Pro Publica) see also Progress Is Seen in Advancing a Final Volcker Rule (DealBook)

• Today’s WTF headline: Is Wall Street Meeting God’s Expectations? (WSJ)

• China Grapples With New Normal (The Diplomat)

• Why is an FT subscription so expensive? (Reuters)

• Edward Luce: America is A Nation of Spoiled Brats (Foreign Policy)

• The Obsessive Habits Of Bruce Berkowitz, Morningstar’s Manager Of The Decade (Business Insider)

• Nooks, Books, and Schnooks (Slate)

• Can Occupy Wall Street Replace the Labor Movement? (Bloomberg)

What are you reading?

>

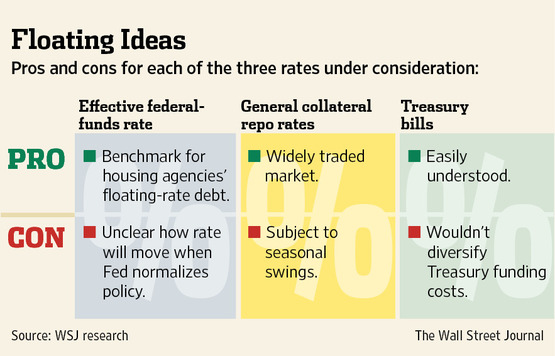

Treasury Doesn’t Sound a New Note

Source: WSJ

What's been said:

Discussions found on the web: