My morning reading material:

• What Makes a Great Stock Analyst? (WSJ)

• Swedish Banks Pummel EU Peers Wallowing in Laxer Rules (Bloomberg)

• Spain nationalises Bankia as euro crisis escalates (The Telegraph) see also Greeks May Hold $510 Billion Trump Card in Renegotiation (Bloomberg)

• It’s All About the Fraud: Madoff, MF Global & Antonin Scalia (Institutional Risk Analyst)

• The ascent of the shadow economy (FT.com) see also Growth of the shadow economy, charted (FT.com)

• Gross Talks His Books, Says (Asks for) QE3 Getting Closer (Bloomberg)

• Post-Financial Crisis – How do the Major Economic Players Stack Up? (Northern Trust)

• You Hate Taxes, but You Ain’t Moving to Nashville (Bloomberg)

• Facebook IPO: Investors should wait (Market Watch)

• The False Truths of Social Finance (Phil Pearlman)

What are you reading?

>

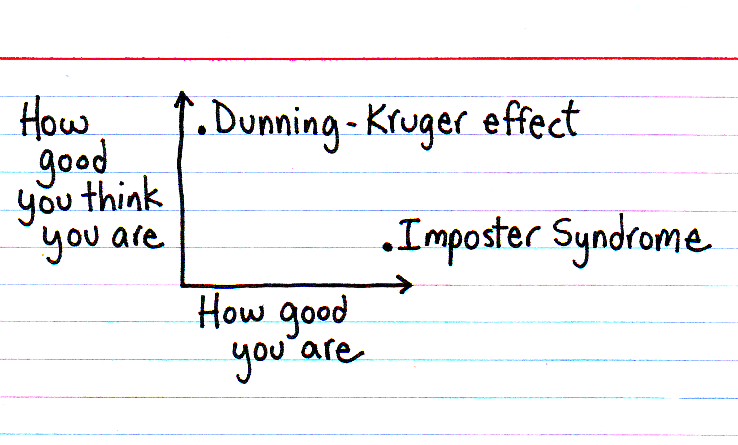

Two annoying problems

Source: Indexed

What's been said:

Discussions found on the web: