My early morning reads:

• ‘The death of equities’… again? (FT Alphaville)

• Inspect Exchange Operations, After Facebook Fiasco? (Securities Technology Monitor) see also Questions of Fair Play Arise in Facebook’s I.P.O. Process (DealBook)

• China’s rich head for the exit (FT.com)

• Austerity or growth? Simple answer is: It depends. (Washington Post)

• More than 30% of mortgage borrowers still underwater (CNN Money)

• Debt crisis: Germany holds a gun to Greece’s head (Telegraph)

• Language: The cussing room floor (Independent)

• The Economics of All-You-Can-Eat Buffets (Forbes)

• How Apple Could Play the Bigger-Display iPhone Thing at WWDC, Which I Swear, I’m Still Not Convinced Is for Real But We’re Getting to the Point Where There’s an Awful Lot of Smoke for There Not to Be a Fire So Let’s Run With It (Daring Fireball)

• Ridley Scott Opens Up About ‘Prometheus,’ Kick-Ass Women, and ‘Blade Runner 2’ (The Daily Beast)

What are you reading?

>

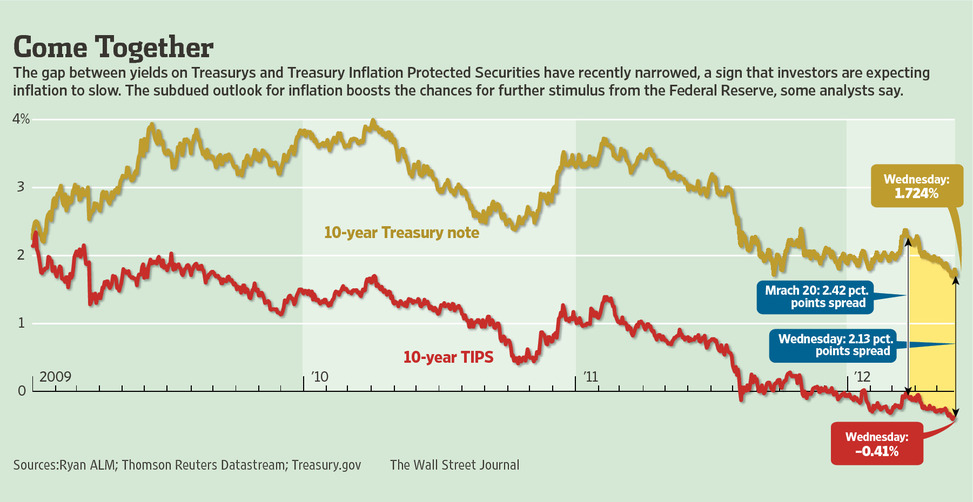

Bond Market Liberates Fed

Source: WSJ

What's been said:

Discussions found on the web: