My early morning reads:

• Facebook: The $100 Billion Oxymoron (Efficient Frontier) see also A Safe Price to Pay for Facebook: $15 (Smart Money)

• May Again Bites Stock Investors (WSJ)

• Facing Down the Bankers (NYT)

• Why FINRA’s power grab for RIAs needs to be stopped to avert the death of the profession (RIA Biz) see also Embracing FINRA, ‘the Devil We Know’ (DealBook)

• JPMorgan CIO Swaps Pricing Said to Differ From Bank (Bloomberg)

• Markets and Morals (NYT) see also Psychology Of Fraud: Why Good People Do Bad Things (npr)

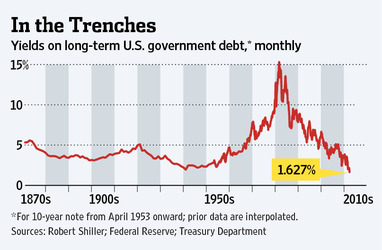

• QE3 Hits European Iceberg (WSJ)

• SEC: Taking on Big Firms is ‘Tempting,’ But We Prefer Picking on Little Guys (Rolling Stone) see also Why S.E.C. Settlements Should Hold Senior Executives Liable (and all of us are more Greek than we think) (DealBook)

• Permission to Fail (Harvard Business Review)

• Daddy, What Were Compact Discs? (NYT)

What are you reading?

>

Heard: QE3 Hits European Iceberg

Source: WSJ

What's been said:

Discussions found on the web: