Afternoon Train Reading:

• Payroll Survey Signals U.S. Jobs Slowing as Orders Drop (Bloomberg) see also New Grads’ Pay Gap Is Lasting Legacy of Recession (WSJ)

• Marginal oil production costs are heading towards $100/barrel (FT.com)

• How To Minimize Fixed Income Portfolio Risks (Ransom Roger)

• New ETFs Backed by Industrial Metals (Institutional Investor)

• Is Wells Fargo a Lehman in the Making? (Naked Capitalism)

• RIM Bets on BlackBerry Without Keyboard to Challenge Apple (Bloomberg)

• Future of Lighting Plays Out in Iowa Town, Global Courts (Bloomberg)

• The Joy of Drawing on Glass (NYT) see also Can Your Preschooler Learn Anything From an iPad App? (Slate)

• One universe among many? (Prospect Mag)

• GOPers flock to Roger Ailes’s Fox News office (Politico)

What are you reading?

>

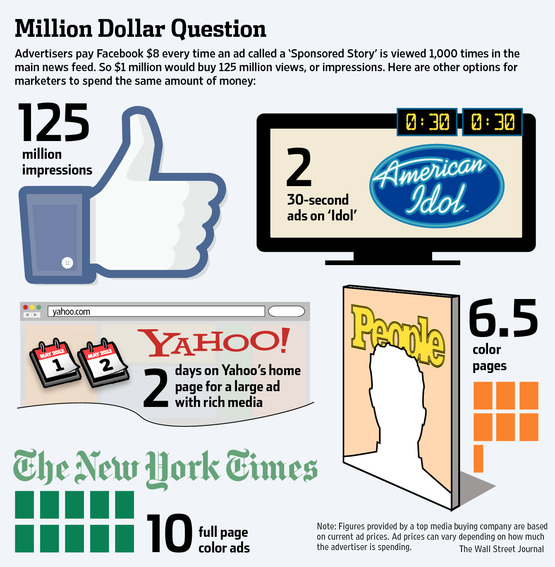

The Big Doubt Over Facebook

Source: WSJ

What's been said:

Discussions found on the web: