My afternoon train reading:

• WTF? Bernanke Gets 75% Approval From Investors in Global Poll (Bloomberg)

• Gold Losing Its Luster (WSJ)

• Avoiding the Next Big Bailout (WSJ) see also Breaking Up Four Big Banks (Economix)

• Still time to make money in Treasury bonds (Market Watch)

• SEC Disagrees with Supreme Court’s Anti-U.S. Investor Morrison Decision (Angry Bear)

• Technology Industry Seen Growing Fastest in New York (NYT)

• Two brilliant moves that helped create the Apple iOS powerhouse (Dalton) see also What retail is hired to do: Apple vs. IKEA (Asymco)

• America’s War on Tourists (Slate)

• Solar Installers Offer Deals, Gaining Converts (NYT)

• Gamma-Ray Bending Opens New Door for Optics (Science Mag)

What are you reading?

>

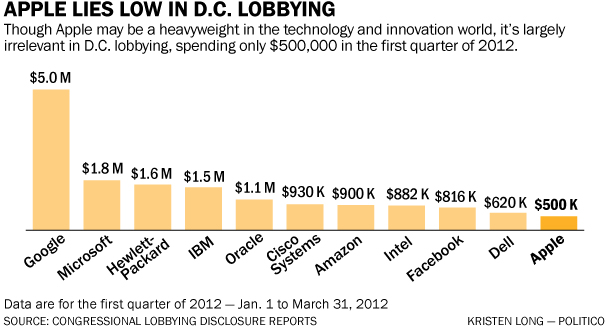

For every $1 Google spends lobbying, Apple spends 10¢

Source: CNN Fortune

What's been said:

Discussions found on the web: