My afternoon reading:

• 71% Say Government Should Let Big Troubled Banks Fail (Rasmussen Report)

• Greece: when the drugs run out (FT.com)

• Queen Elizabeth, Venture Capitalist for Marauders (Bloomberg)

• Lampert Skeptics Could Get Seared on Sears (WSJ)

• Investigating JPMorgan Chase (Economix)

• Rand Paul’s cynical budget (Washington Post)

• How Yahoo Killed Flickr and Lost the Internet (Gizmodo)

• Coffee May Help Drinkers Live Longer, U.S. Study Suggests (Bloomberg)

• WTF? The manhood makeover: The rise of the penis enlargement (Independent)

• TONITE: Conan O’Brien to Appear on Letterman Show (NYT)

What are you reading?

>

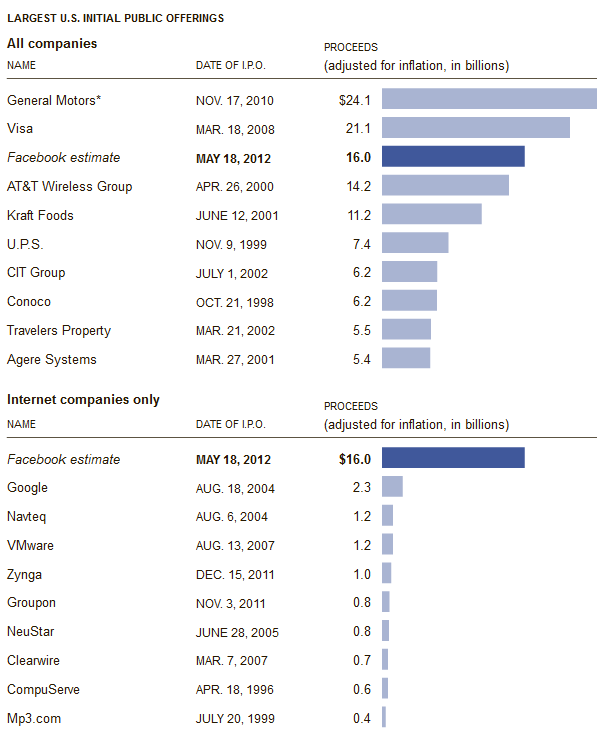

How Facebook’s I.P.O. Compares

Source: NYT

What's been said:

Discussions found on the web: