My afternoon train reading:

• Euro Zone Crisis Boils as Leaders Fail to Signal New Steps (NYT)

• Copper ETF plan would ‘wreak havoc’ (FT.com)

• Passive Asset Allocation Strategies Are Still Tough To Beat (Capital Spectator) but see Why a ‘Balanced’ Portfolio May Not Work (SmartMoney)

• Seeing Bailouts Through Rose-Colored Glasses (NYT)

• Farrell: How Facebook could destroy the U.S. economy (Market Watch)

• J.P. Morgan and ‘Asymmetric Accounting’ (WSJ) see also Baum: Stop the Big Banks Before They Can Lend Again (Bloomberg)

• Nervous investors are looking beyond positive U.S. economic signs (LA Times)

• Facebook IPO Post Mortem – Killer – but not for the reasons you think ! (Blog Maverick) see also Greenshoes, Facebook phantoms and ETF magic (FT.com)

• Data journalism research at Columbia aims to close data science skills gap (O’Reilly Radar)

• Robert Carlock walks us through highlights from 30 Rock’s six seasons so far (Part 1 of 4) (AV Club) (Part 2 of 4) (AV Club)

What are you reading?

>

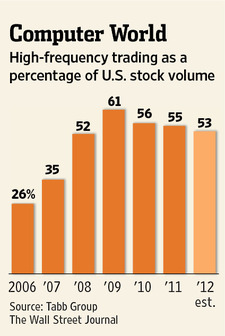

Mutual Funds Promised Haven From Speedsters

Source: WSJ

What's been said:

Discussions found on the web: