My afternoon train reading:

• Banks’ Hyper-Hedging Adds to Risk of a Market Meltdown (Bloomberg)

• Euro Isn’t Loved, but Few Want to Drop It, Poll Says (NYT)

• Republican Keynesians (Economix)

• Why we’re right to worry about the Facebook IPO (Reuters)

• Is Chinese real estate nearing a tipping point? (FT.com)

• Young, Educated and Seeking Financial Security (Economix)

• Meet ‘Flame’, The Massive Spy Malware Infiltrating Iranian Computers (Wired) see also The NSA is intercepting 1.7 billion American electronic communications, daily (After Dawn)

• How Teeny, Tiny Transistors Are Born in a Near-Total Vacuum (Wired)

• Manhattanhenge: Sunset on the Manhattan Grid (Hayden Planetarium)

• 2012 Philip K. Dick Festival (Philip K. Dick Festival)

What are you reading?

>

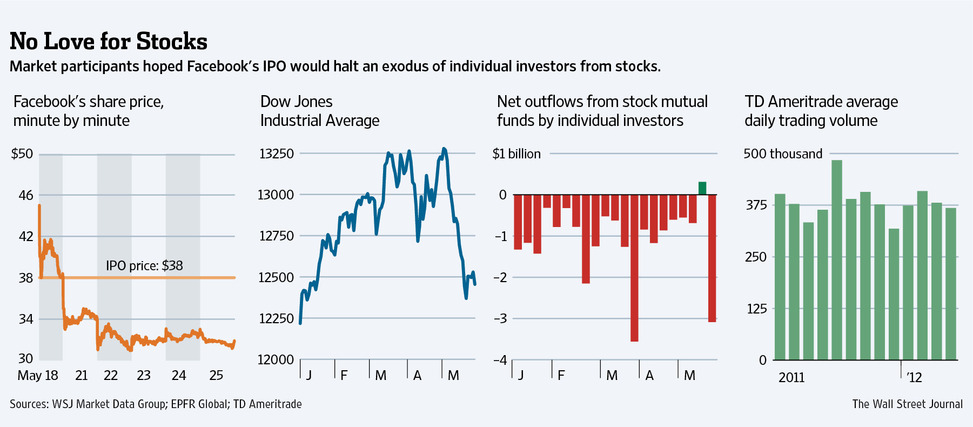

Stock Market Loses Face

Source: WSJ

What's been said:

Discussions found on the web: