Pour a cup of strong Joe, get comfortable in your favorite chair, and enjoy these longer form articles –they are what I am reading this weekend:

• The brain… it makes you think. Doesn’t it? (The Guardian)

• How Wall Street Killed Financial Reform (Rolling Stone)

• Zuckerberg: The Maturation of the Billionaire Boy-Man (NY Mag)

• How the Corvair’s rise and fall changed America forever (Reuters)

• Joe Weisenthal vs. the 24-Hour News Cycle (NYT Mag)

• How Hewlett-Packard lost its way (CNN Fortune)

• Hedging is a Tricky and Mercurial Thing (The Epicurean Dealmaker)

• Complex Philosophical Theories Explained in Basic Shapes (My Modern Met)

• The Duke Ellington collective (The Times Literary Supplement)

• The Inquisition of Mr. Marvel: On the surprisingly complicated legacy of Stan Lee (Grantland)

Whats on your tablet?

>

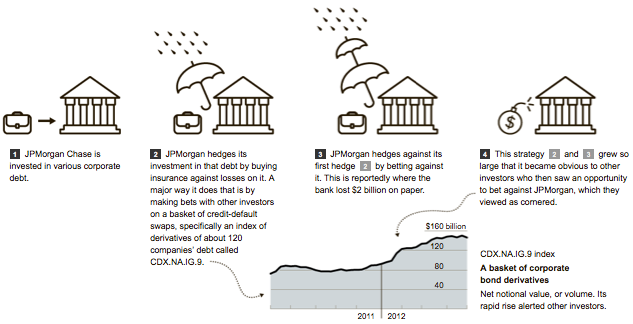

At JPMorgan Chase, a Complex Strategy That Backfired

click for much larger infographic

Source: NYT

What's been said:

Discussions found on the web: