Reuters – U.S. lets China bypass Wall Street for Treasury orders

China can now bypass Wall Street when buying U.S. government debt and go straight to the U.S. Treasury, in what is the Treasury’s first-ever direct relationship with a foreign government, according to documents viewed by Reuters. The relationship means the People’s Bank of China buys U.S. debt using a different method than any other central bank in the world. The other central banks, including the Bank of Japan, which has a large appetite for Treasuries, place orders for U.S. debt with major Wall Street banks designated by the government as primary dealers. Those dealers then bid on their behalf at Treasury auctions. China, which holds $1.17 trillion in U.S. Treasuries, still buys some Treasuries through primary dealers, but since June 2011, that route hasn’t been necessary. The documents viewed by Reuters show the U.S. Treasury Department has given the People’s Bank of China a direct computer link to its auction system, which the Chinese first used to buy two-year notes in late June 2011. China can now participate in auctions without placing bids through primary dealers. If it wants to sell, however, it still has to go through the market.

Comment

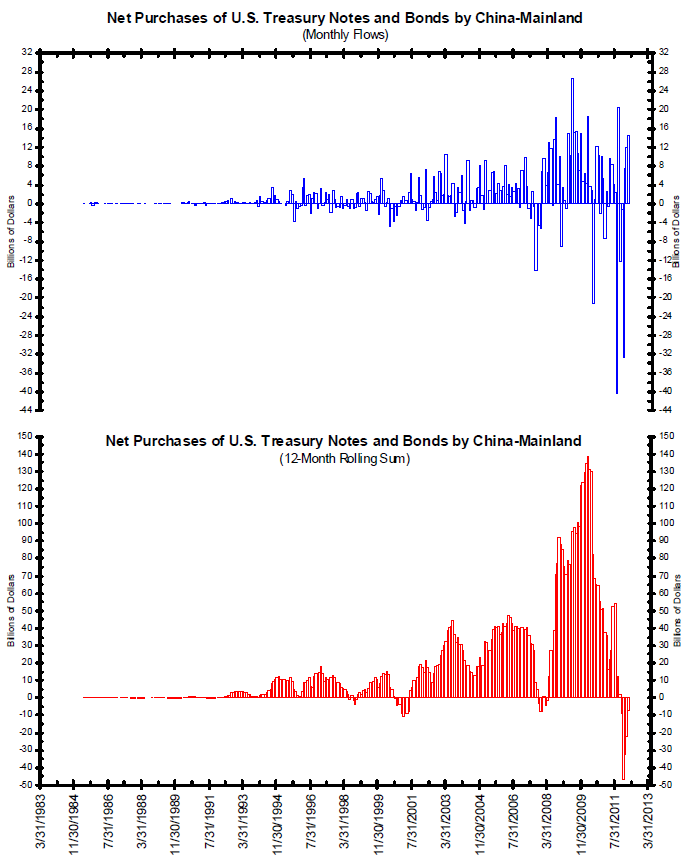

This story helps explain a lot in regards to some of the official outflows shown seen in the chart below since 2011. If Chinese officials are able to completely bypass the primary dealers when purchasing Treasuries, then a large chunk of these transactions will never be recorded in the TIC data.

While it is impossible to say how large an effect this rule change has had on the official purchases shown below, it is probably no coincidence that the two largest monthly outflows ever came within a month or two of the June 2011 change. As the story states, while China can bypass the dealers for purchases, it must still sell through them. This could put a downward bias on the way in which the Treasury reports these purchases going forward.

Click to enlarge:

Source:

Bianco Research

Charts Of The Week

May 23, 2012

What's been said:

Discussions found on the web: