Source: Bianco Research

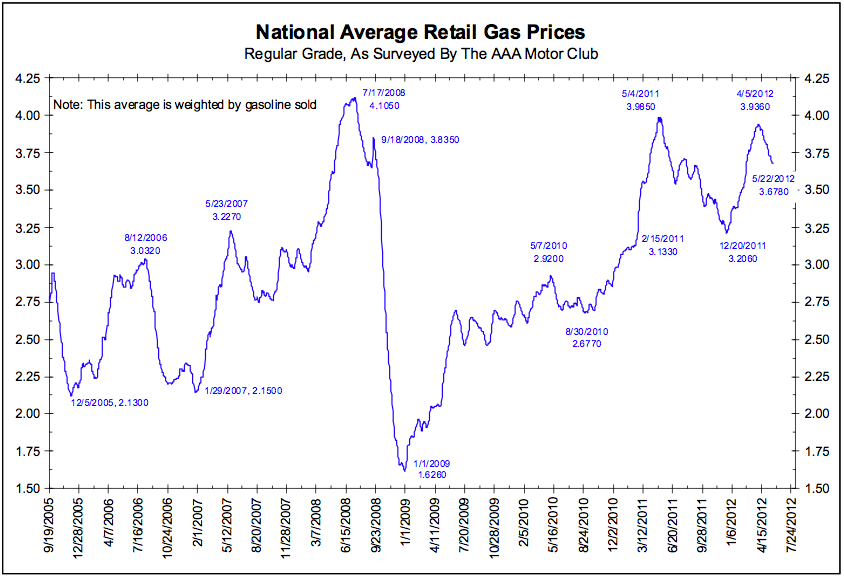

Its the official start of the summer driving season — and that means a closer look at gasoline prices.

The peak this year was earlier than last — April 5 (2012) at 3.936 versus May 4 (2011) and 3.955.

No recent year compares to the 2008 peak at 4.105.

What's been said:

Discussions found on the web: