ADP reports:

Employment in the U.S. nonfarm private business sector increased by 133,000 from April to May on a seasonally adjusted basis. The estimated gain from March to April was revised down modestly, from the initial estimate of 119,000 to a revised estimate of 113,000. Employment in the private, service-providing sector increased 132,000 in May, after rising a revised 119,000 in April. Employment in the private, goods-producing sector increased 1,000 in May. Manufacturing employment dropped 2,000 jobs, the second consecutive monthly decline.

The Wall Street Journal – Don’t Expect the Jobs Report to Halt the Selloff

Normally, we’d have already started chewing through jobs numbers today because ADP usually releases its jobs report the Wednesday before the Friday BLS’s nonfarm payrolls report. But ADP delayed the release until tomorrow (8:15), due to Monday’s holiday. The estimate for both ADP and the nonfarm payrolls are strikingly similar: about 150,000 for ADP, 155,000 for the BLS. ADP historically can be very wide of the mark. For that reason, it would have to come in wildly higher to get people excited about Friday’s report. TrimTabs is another firm that offers a monthly jobs report the Wednesday before the BLS’s Friday release, and it put job growth at only 124,000 in May. (Actually, TrimTabs should consider moving its release date, put a little distance between them and ADP. Just some free advice, fellas.)

Calculated Risk (blog) – ADP: Private Employment increased 133,000 in May

Comment

As is often the case, today’s ADP report will be analyzed closely as the purpose of the ADP report is to guess Friday’s payroll number. That is why it uses the same methodology and reporting (measured in thousands of jobs and not as an index level) and is released 48 hours before payrolls. Beyond offering a guess on payrolls, we believe this report offers little new information about the jobs situation.

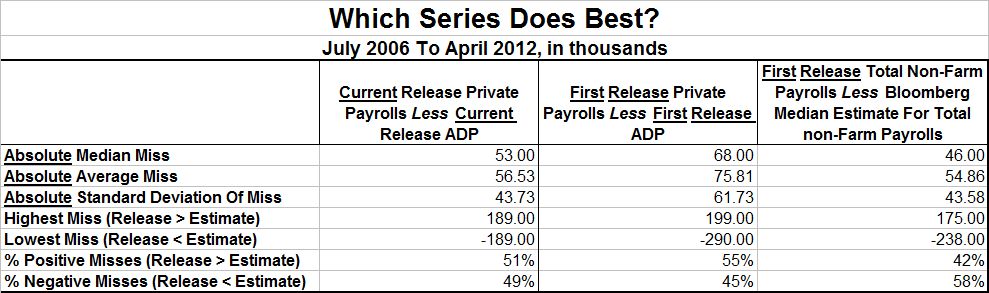

The table below starts in July 2006 (the last major revision to ADP).

The left column shows the difference between the current release of private payrolls versus the current release of ADP. “Current” means it includes the latest revisions as both private payrolls and ADP are revised. The median absolute miss is 53,000 with a standard deviation of 43,730. This is shown in the first two-panel chart below.

The center column shows the difference between the first release of private payrolls versus the first release of ADP. The median absolute miss is 68,000 with a standard deviation of 61,730. This is shown in the second two-panel chart below.

The right column shows the difference between the first release of non-farm payrolls versus the Bloomberg median estimate for non-farm payrolls. Non-farm payrolls will be released tomorrow and the Bloomberg survey estimates a gain of 150,000 jobs. The median absolute miss is 46,000 with a standard deviation of 46,580. This is shown in the third two-panel chart below.

So does ADP enlighten us about the employment situation and/or tomorrow’s payroll report? It depends on what measures we are comparing.

The center column, showing the difference between the first release of ADP versus tomorrow’s first release of the private payroll report, is what we all focused on this morning. With a median absolute miss of 68,000 and a standard deviation of 61,730, note that it is the least accurate predictor of the jobs situation. Economists would presumably be more concerned with the current release of ADP relative to payrolls. While ADP does a slightly better job at predicting this number, it is still not the most accurate of the three. Traders, being most interested in predicting the non-farm payroll number, would be best served to focus on Bloomberg’s median estimate shown in the right-hand column.

Restated, ADP does not tell us anything more than the consensus estimate. The consensus is more accurate at predicting the non-farm payroll number and does it with a smaller standard deviation.

So, what did we learn this morning with the ADP report? What do we learn any morning the ADP report is released? Compared the the median estimate of economists, it did not tell us anything new.

Click to enlarge:

Left Column From Table Above

Center Column From Table Above

Right Column From Table Above

Source:Bianco Research

What's been said:

Discussions found on the web: