Russell describes this as follows:

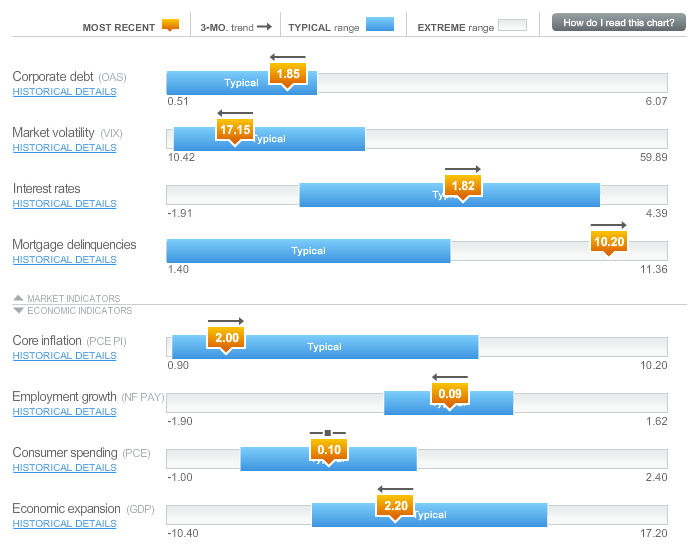

Market indicators — Corporate debt spreads, the month–end VIX, and interest rates remain within typical ranges. U.S. equity markets ended April down with the Russell 3000® Index posting a return of -0.66%.

Economic indicators — These backward–looking indicators are all within typical ranges. The economy grew at a rate of 2.2% during the first quarter.

What's been said:

Discussions found on the web: