Source: Calculated Risk

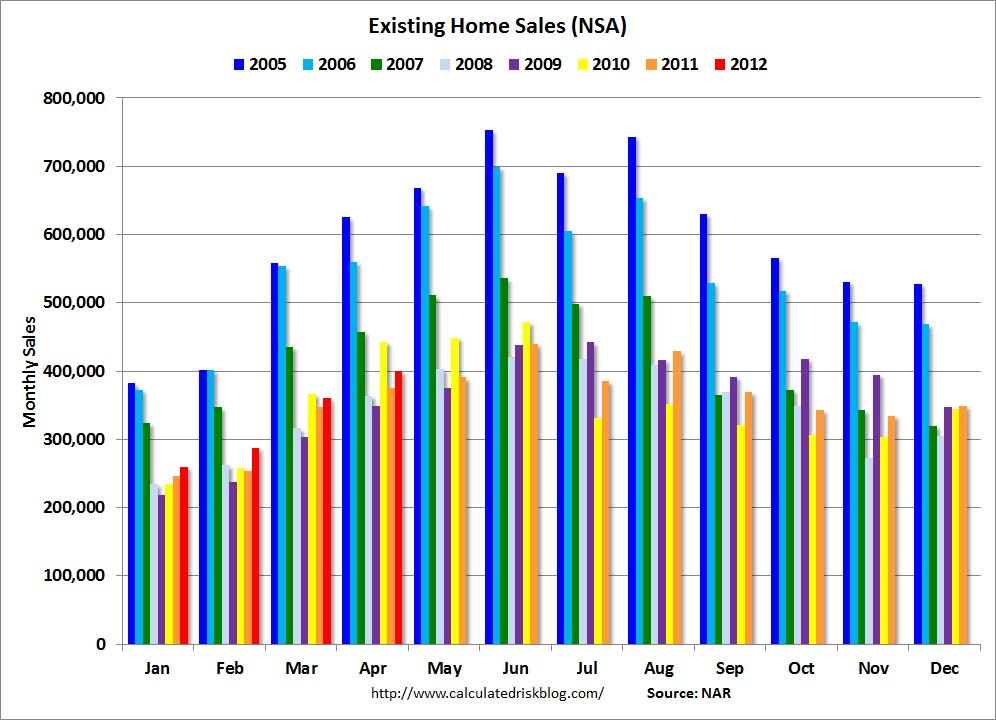

Existing Home Sales were released today. To back out the strong effect seasonality has on this data, we prefer using the NSA chart (above).

Existing-home sales rose in April and remain above a year ago at a slightly better sales pace than April 2011, but they remains significantly lower than April 2010. (If you use seasonally adjusted data. The National Association of Realtors (a/k/a the hype-meisters of housing) touted a 10.1% increase in median price to $177,400.

Don’t be misled by this data point. The key driver of it price difference is the result of the voluntary foreclosure abatement while the robo-signing settlement was progressing. When we compare year-over-year distressed sales (foreclosures and short sales) we see they were down to 28% for April 2012 (17% foreclosures, 11% short sales), a whopping 9% lower than the 37% in April 2011.

Thus, the increase in price can be accounted for by lack of distressed sales in the mix — the price dispersion — and not by any actual increase in home prices.

Now that those legal issues are behind the banks, we should expect mortgage loan servicers to begin once again the foreclosure process — and that means more distressed sales to come . . .

Source:

April Existing-Home Sales Up, Prices Rise Again

Realtor.org May 22, 2012

http://www.realtor.org/news-releases/2012/05/april-existing-home-sales-up-prices-rise-again

Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

CalculatedRisk 5/22/2012

http://www.calculatedriskblog.com/2012/05/existing-home-sales-in-april-462.html

What's been said:

Discussions found on the web: