Steve Waldman was a software developer who became fascinated by finance and started writing about it. He is now a doctoral student in finance at the University of Kentucky. He blogs at Interfluidity.

~~~

Richard Williamson offers a report from the UK. Combining bits via Tyler Cowen and Williamson’s own excellent blog:

I think there has been a lot missing from the discussion of the UK in the blogosphere. We are a bit of a puzzle on a purely AD-based explanation of the recession.

We didn’t have deflation (on annual basis at least), and even stripping out the effect of the VAT rise in 2011 should still show persistent inflation over 3% since 2010. United Kingdom Inflation expectations seem to be significantly higher here (if falling away a little recently)

…

I’m not really sure what is going on… If we were to just look at inflation (at expectations thereof), the country that ought to be having an AD-driven double-dip recession would appear to be the US…I am becoming steadily less convinced that [an aggregate demand deficiency] is the whole story, at least for the UK. Back in November, Karl Smith made the clearest statement I have ever read of the New Keynesian explanation of a recession:

I can’t hammer this home enough. A recession is not when something bad happens. A recession is not when people are poor.

A recession is when markets fail to clear. We have workers without factories and factories without workers. We have cars without drivers and drivers without cars. We have homes without families and families without their own home.

Prices clear markets. If there is a recession, something is wrong with prices.

Right now, unemployment remains at over 8% in the UK while real wages are lower than they were 7 years ago and are continuing to fall. Yes, you read that correctly. Which immediately leads one to ask: on this explanation of a recession as expounded by Karl, how much further do real wages have to fall to eliminate disequilibrium unemployment?

There are two broad stories having to do with “sticky prices”. One, the mainstream New Keynesian story, emphasizes rigidity in the price of goods and services, most especially “sticky wages”. The other, emphasized by post-Keynesians and sometimes by monetarists, has to do with the sticky price of satisfying debts.

In the standard New Keynesian story, a depression is caused by the relative prices of goods and services falling out of whack. This is the basis for much of the mainstream policy consensus. The source of macroeconomic problems is sluggish adjustment of some goods and service prices, and stabilizing the price level should diminish the need for such adjustments. Macro policy can’t prevent relative prices in the real economy from needing to change sometimes. But it can prevent difficult-to-adjust prices from requiring frequent updates due to fluctuations in the overall price level. Because some important prices – the price of labor especially – are thought to be “sticky downward” (meaning they can “ratchet” upwards but can’t adjust down), targeting a positive inflation rate is recommended. The gradual, predictable movement of prices allows slow updates, preventing misalignments due to sluggish adjustment. The upward-slope permits “sticky downward” prices to fall in real terms relative to other goods and services by simply not rising with other prices. A recession, in the New Keynesian telling, occurs when this stabilization policy is not sufficient. If changes in supply and demand are so great that “sticky downward” prices must fall faster than the targeted rise in the price level, markets won’t clear. If the “sticky downward” price is workers’ wages, then it is employment markets that won’t clear, and we will experience mass joblessness. If this occurs, a cure would be to increase the targeted rate of inflation until real wages fall relative to other goods and services. When real wages fall enough, employment markets will clear again and the recession will end.

In the post-Keynesian story, a depression is driven by an decrease in agents’ willingness or ability to carry debt. Agents “pay for” decreased indebtedness by devoting their income to the purchase of safe assets (including especially their own outstanding debt) rather than spending on real goods and services. Unfortunately, money spent on financial asset purchases does not create income (they are asset swaps), and may not be cycled back into income for producers of real goods and services. So, in aggregate the attempt to reduce indebtedness can lead to a reduction of income that sabotages the attempt to pay down debt. This is the famous “paradox of thrift”. We simultaneously experience unemployment (reduced spending and income to real goods and service providers plus sticky wages means that people get canned) and financial distress (reduced income and fixed debt makes prior debt ever more burdensome). In this story, reducing real wages is not a solution. Real wage reductions might mitigate unemployment temporarily, but they also engender financial distress. Financial distress then causes agents to redouble their efforts to satisfy debts, reducing aggregate income and requiring further reductions in real wages ad infinitum. The only way out of a post-Keynesian depression is to increase real wages relative to the real burden of debt. In the post-Keynesian story, inflation is helpful only if real incomes hold steady, or, at very least, fall more slowly than the real value of prior debt.

One data point is not dispositive. But Williamson’s account of the UK experience is not consistent with the New Keynesian story, while it is perfectly consistent with the post-Keynesian account. There has been inflation in the UK. The real price of labor has not been sticky. The real burden of debt has fallen, sure, but real wages and incomes have fallen even farther, leaving people less able than ever to satisfy debts they’ve contracted and so purchase financial security.

There is a lesson here. If we mean to pursue reflationary policy, the goal should not be to reduce real wages, but to reduce the real value of debt relative to incomes. One way to do this, which the post-Keynesians’ closest frenemies suggest, is to stabilize the nominal income path at its prior trend while tolerating whatever inflation that engenders. This implies a large increase in nominal income from current levels. Going forward, if we hold nominal income to a gently rising path, the burden of aggregate debt relative to income will never unexpectedly rise. (Unfortunately, predictable distress may not prevent debtors in aggregate from taking on more debt than they can service, due to the competitive dynamic of a boom. I think NGDP targeting would be a big improvement, but not sufficient: We must always be mindful of leverage and debt.)

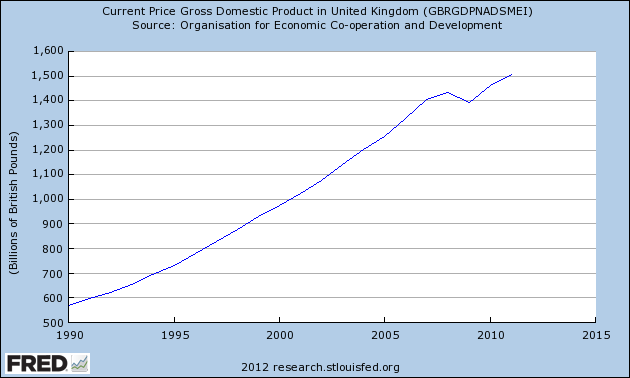

Pace the very brilliant Chris Dillow, the UK has not stabilized the path of NGDP:

Even if, as Dillow suggests, policymakers could not have held NGDP on path in 2009 due to forecast error, after the collapse they certainly could have restored total income to its prior trend with some combination of monetary and fiscal policy. They have not, and so the burden of debt relative to incomes in the UK has increased.

The UK has just entered a “double-dip” recession, and remains, in my view, in a depression, despite occasional thaws and recoveries. That this has happened, despite the plummeting real wages that Williamson reports, tells a tale. It is not “sticky wages” that should concern us, but the sticky burden of precontracted nominal debt.

Afterward: David Andolfatto wonders whether debt dynamics could play so large a role more than three years after a collapse in nominal income. Yes it can, I argue in his comments.

Karl Smith responds to Williamson here.

Update History:

28-Apr-2012, 6:00 a.m. EDT: Had mistakenly used a FRED graph that I thought was NGDP, but was really RGDP. I’ve replaced it with a proper NGDP graph. Removed the word “remotely”, as the proper graph shows a less dramatic picture: “the UK has not remotely stabilized the path of NGDP.

This entry was posted on Saturday, April 28th, 2012 at 5:33 am and is filed under uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

What's been said:

Discussions found on the web: