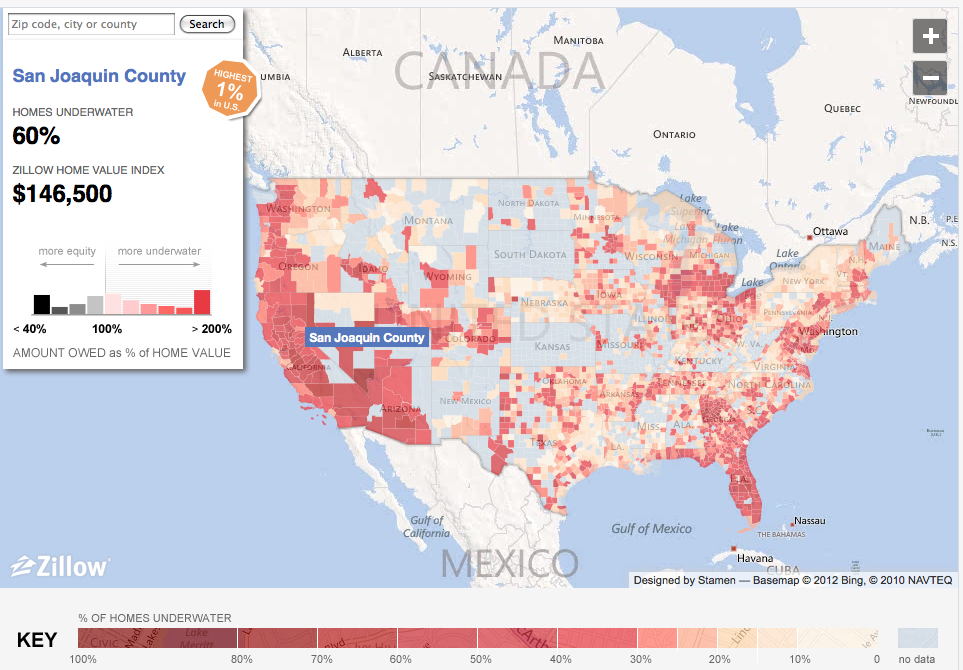

With U.S. home values off 35% from peak to tough, about 25% of those homeowners who have mortgages are now underwater — their mortgages are greater than the value of their homes.

Zillow’s interactive map revelas what percentage of homes in your county or ZIP code are in negative equity, based on Q1 2012 data.

The United States of Atlantis

click for full interactive map

Zillow

What's been said:

Discussions found on the web: