>;

Update: the Gallup poll used the word “Best” not “Safest”.

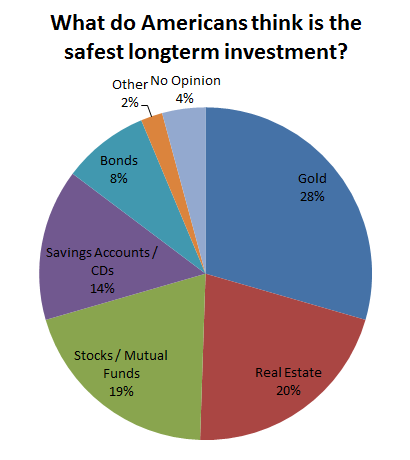

Jordan Weissmann has a fascinating discussion going on at the Atlantic about a recent Gallup poll regarding “safe investments.” (The full discussion is well worth your time). Its appears that a plurality of “Americans believe Gold is the single safest long term investment option.”

For the second straight year, an annual Gallup poll has found that a plurality of Americans believe gold is the single safest long term investment option. Safer than savings accounts. Safer than real estate. Safer than stocks. A full 28 percent of adults ranked gold as their top choice, down from 34 percent last year, a drop just outside the five point margin of error. It was most popular among older Americans, those without a college a degree, and individuals who earned between $30,000 and $75,000 a year.

Note that the question isn’t the BEST investment or the HIGHEST RISK ADJUSTED RETURNS, but rather, the safest. We can define safety by looking at a) return of capital and b) liquidity.

For the record, as the SAFEST investment, I would personally have picked US Treasuries. (Only 8% of Americans picked bonds). My expectations are extremely high that I would get paid back in full the capital I invested, and have no problem exercising that redemption. We shall save a discussion of counter-party risks and paper claims on gold for a latter date.

New marketing tagline for the ETF GLD: Gold: Its what the public thinks is safest.

>;

Source:

Is Gold Today’s Safest Investment?

Jordan Weissmann

The Atlantic May 3, 2012

http://www.theatlantic.com/business/archive/2012/05/24k-nation-are-americans-crazy-to-think-gold-is-the-safest-investment/256653/

What's been said:

Discussions found on the web: