Reuters.com – COMMODITIES-Markets tumble again; CRB at 20-month low

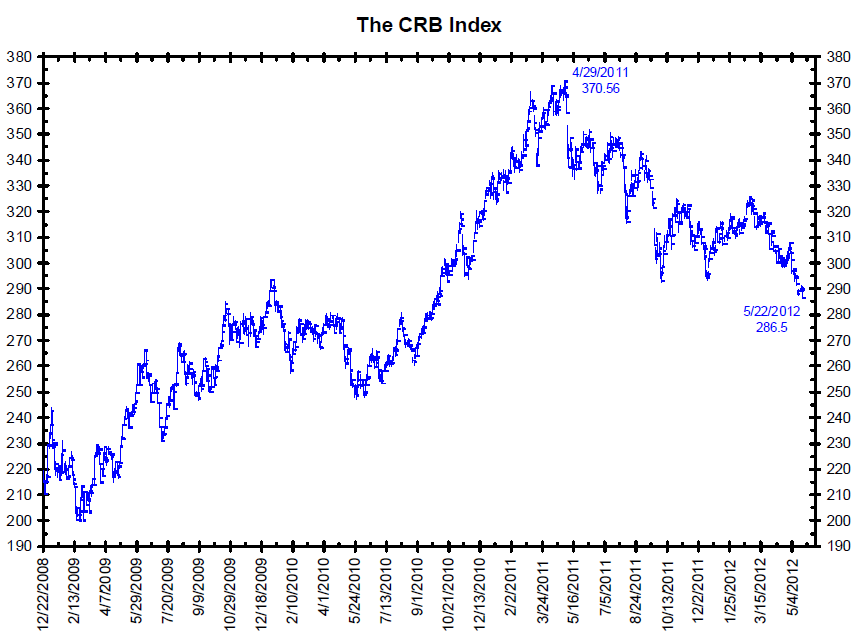

The sell-off in commodities showed little signs of abating on Wednesday as the dollar’s relentless climb against the euro and fears of a Greek exit from the euro zone forced a fresh tumble in prices of grains, metals and oil. The 19- commodity Thomson Reuters-Jefferies CRB index – a global benchmark for the asset class – extended the 20-month lows of the previous session, falling 1.5 percent to a bottom not seen since September 2010. Oil prices fell about 2 percent, with U.S. crude coming precariously close to testing its $90 per barrel support. Benchmark Brent crude in London was trading below $107. “The selling will stop when the market is convinced that the uncertainty surrounding Greece and the rest of the sovereign debt issues in Europe are truly over and the macroeconomic data starts to improve,” said Dominick Chirichella of New York’s Energy Management Institute. The euro fell to an August 2010 low against the dollar amid uncertainties over Greece’s forthcoming elections and worry about the health of Spanish banks.The dollar also gained against the euro after U.S. new home sales rose more than expected in April.

Click to enlarge:

Source:

Bianco Research

Charts Of The Week

May 23, 2012

What's been said:

Discussions found on the web: