The New York Times – In Spain, Bank Transfers Reflect Broader Fears

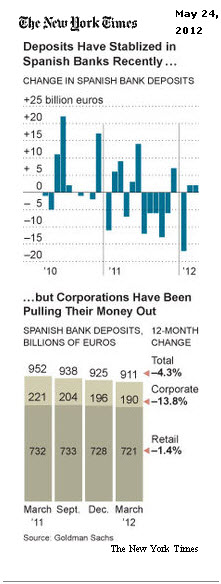

Ángel de la Peña, a Spanish government worker, is seriously considering the once unthinkable: converting some of his savings from euros to British pounds. Alvaro Saavedra Lopez, a senior executive for I.B.M. in Spain, says many of his corporate counterparts across the country are similarly looking for safer havens by transferring their spare cash to stronger euro zone countries like Germany “on a daily basis.” It is only a trickle so far, and not nearly enough to constitute a classic bank run. But these growing transfers of deposits out of troubled Spanish banks reflect a broader fear that the country’s problems could make it hard for Spaniards to get to their money if banks fail and cannot be supported by the government. In a worst case, some even worry their money will be worth substantially less if Spain is forced to leave the euro currency zone and re-adopt its old currency, the peseta. Money already has been pouring out of banks in Greece, where many citizens believe it is increasingly likely that their country will be forced to leave the euro zone. But for European policy makers and economists, the possibility of mini-runs on banks spreading from Greece to other, bigger countries like Spain — with 1 trillion euros, or $1.25 trillion, in bank deposits — poses a much more serious risk. Indeed, the outflow of money from Spanish banks could increase if the ratings agency Standard & Poor’s, as expected, downgrades Spanish banks, in effect saying that their weakened state makes them riskier.

Comment

The story above illustrates what Bill Gross said on CNBC yesterday very well:

“It may not necessarily be decided at the ballot box, it’s decided at the ATM machine in assets, to the extent that those machines are drained of euros,” he said. “Then at some point the exit becomes necessary. A long weekend perhaps makes it orderly, but perhaps not.”

The Financial Times – Big European funds dump euro assets

Some of Europe’s biggest fund managers have confirmed they are dumping euro assets amid rising fears over a possible Greek exit from the eurozone and single currency turmoil.

The euro’s sudden fall this month caught many investors by surprise. Europe’s single currency has lost 5 per cent in the past three weeks after barely moving against the US dollar for much of the year. On Thursday, the euro hit a fresh 22-month low at $1.2514. Amundi, Europe’s second-biggest private fund manager, and Threadneedle Investments, the big UK manager, have cut their exposure to the euro in recent days as frustration grows with political leaders’ efforts to resolve the crisis.

Source: Bianco Research

What's been said:

Discussions found on the web: