My afternoon plane reading:

• Berkshire 2012: A Glimpse of Things to Come (Jeff Matthews Is Not Making This Up)

• 4 years after Wall Street crash, regulation of financial markets is still spotty (McClatchy)

• Rents soar as foreclosures, young workers seek housing (LA Times) see also Look Who’s Pushing Homeowners Off the Foreclosure Cliff (Bloomberg)

• 2012: Youngs v. Olds (Salon)

• Regulators Seek Plan B on Money Funds (WSJ) see also Taking On the Little Guy, but Missing the Bigger Ones (DealBook)

• Why Alternatives?: Global Debt Panel at CFA (Attain Capital Management)

• Will Rich People Desert the U.S. If Their Taxes Are Raised? (Economix) see also America’s idiot rich (Salon)

• Analytical Trend Troubles Scientists (WSJ)

• Twitter ‘will be more valuable than Facebook’ (Telegraph) see also A Day in the Life of Steve Jobs (Forbes)

• Massive Projection, anyone? Conservatives Describe Themselves in Attacks on Liberals (They Gave Us A Republic)

What are you reading?

>

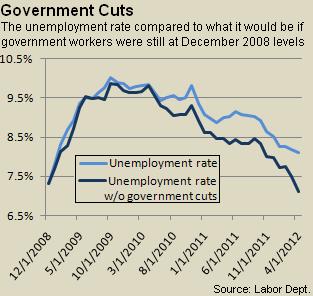

Unemployment Rate Without Government Cuts: 7.1%

Source: WSJ

What's been said:

Discussions found on the web: