The Wall Street Journal – J.P. Morgan’s $2 Billion Blunder

Bank Admits Losses on Massive Trading Bet Gone Wrong; Dimon’s Mea Culpa

A massive trading bet boomeranged on J.P. Morgan Chase & Co., leaving the bank with at least $2 billion in trading losses and its chief executive, James Dimon, with a rare black eye following a long run as what some called the “King of Wall Street.” The losses stemmed from wagers gone wrong in the bank’s Chief Investment Office, which manages risk for the New York company. The Wall Street Journal reported early last month that large positions taken in that office by a trader nicknamed “the London whale” had roiled a sector of the debt markets.

Comment

We have been dissatisfied with the explanations of what happened at J.P. Morgan. Let us try to sum up the situation.

Who Is The London Whale?

J.P. Morgan’s London office has a credit default swap trading group called the Chief Investment Office or CIO. The group is run by Bruno Michel Iksil. Officially the CIO group was supposed to be in charge of hedging J.P. Morgan’s credit exposure.

Mr. Iksil was not known outside the world of CDS trading until an April 6 Wall Street Journal and April 6 Bloomberg article dubbed him “the London whale.” So secretive is Mr. Iksil that no picture has surfaced of him (yet). The passage below comes from the WSJ article:

In recent weeks, hedge funds and other investors have been puzzled by unusual movements in some credit markets, and have been buzzing about the identity of a deep-pocketed trader dubbed “the London whale.” That trader, according to people familiar with the matter, is a low-profile, French-born J.P. Morgan Chase & Co. employee named Bruno Michel Iksil. Mr. Iksil has taken large positions for the bank in insurance-like products called credit-default swaps. Lately, partly in reaction to market movements possibly resulting from Mr. Iksil’s trades, some hedge funds and others have made heavy opposing bets, according to people close to the matter… However, Mr. Iksil has turned more upbeat recently. He has been selling protection on an index of 125 companies in the form of credit-default swaps. That essentially means he is betting on the improving credit of those companies, which he does through the index—CDX IG 9—tracking these companies.

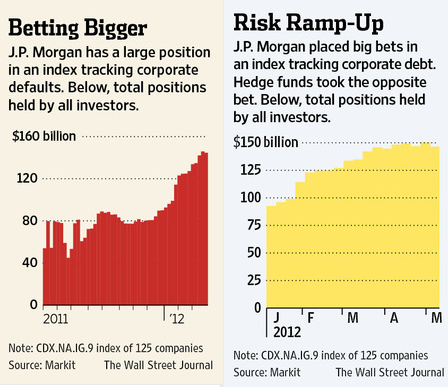

So Mr. Iksil’s CIO group had amassed a huge position in the CDX series 9. And, as the charts from the Wall Street Journal above show, the positions in this derivative alone totaled over $150 billion dollars. J.P. Morgan’s December 31, 2010 10-K filing revealed the CIO group held $350 billion in investment securities which made up 15% of J.P. Morgan’s assets.

Stories of Mr. Iksil and his large positions reminded us and others of another huge CDS trader based out of London, AIG’s Joe Cassano. When Cassano’s position went bad in late 2008, it cost AIG $200 billion in losses. The company needed to be bailed out the by Federal Reserve and nearly took down the entire financial system.

Did J.P. Morgan’s Management Learn Of The London Whale In The Paper?

After The Wall Street Journal and Bloomberg articles, the CIO group stopped trading CDS. From an April 10 WSJ article:

A J.P. Morgan Chase trader whose massive derivatives sales in recent months earned him the nickname the “London whale” has stopped making those trades, for now. But investors that were squeezed in his earlier action remain engaged in high-stakes strategies against the trader. Dozens of hedge funds are believed to have placed bets in the derivatives markets that pit them against positions taken by Bruno Iksil, the French-born trader who works for the bank’s Chief Investment Office in London, according to people familiar with the matter.

The five largest banks in the United States hold over 75% of all banking assets. This is the highest concentration of banking assets among the top five firms in American history. The concern of banks being too big to fail is worse now than before the financial crisis.

With these large financial intuitions comes the belief that they are also too big to manage. The joke going around when these stories initially broke was that a lot of J.P. Morgan’s senior management first learned of the CIO’s activity by reading The Wall Street Journal. That looked less like a joke after J.P. Morgan stopped CIO’s trading within four days of the stories. If J.P. Morgan’s management knew all about these positions and approved of them, why stop CIO from trading because of media stories?

Is The Phrase “Tempest In A Teapot” Misleading And Fraudulent?

On April 13 J.P. Morgan reported its quarterly results and addressed media reports about the London whale.

J.P. Morgan Chief Financial Officer Doug Braunstein and Chief Executive Jamie Dimon scoffed at recent media reports and concerns about an outsized trader dubbed the “London Whale.” “The CIO balances our risks,” Braunstein told media members on a conference call. “They hedge against downside risk, that’s the nature of protecting that balance sheet.” Braunstein added the bank is “very comfortable with the positions we have” and that all of the positions are “very long term in nature.”…Dimon chimed in that every bank has similar positions, though the size depends on the size of the bank, and added that regulators “see everything we do whenever they want.” He called the issue a “tempest in a teapot.”

Braunstein and Dimon have responsibilities to make accurate and truthful statements. If a month later they hold a hastily arranged conference call to announce everything they thought about the CIO group was wrong and they lost tons of money, did they suspect this might be a problem on April 13? If so, did they then make fraudulent statements? If not, why did they stop this group from trading on April 10?

Dimon Learns A Lot About His Firm From Reading The Paper

In the conference call yesterday, J.P. Morgan’s CEO Jamie Dimon said:

Jamie Dimon: Regarding what happened, the synthetic credit portfolio was a strategy to hedge the firm’s overall credit exposure, which is our largest risk overall in this stressed credit environment. We’re reducing that hedge. But in hindsight, the new strategy was flawed, complex, poorly reviewed, poorly executed, and poorly monitored. The portfolio has proven to be riskier, more volatile, and less effective as an economic hedge than we thought.

And this …

Q – Brennan Hawken: And the implication I guess might have been that there

was all this press speculation about certain trading individuals out of

London. Were some staff fairly new that came into execute this new or this –

some of this new angle, and are those folks no longer in that? That’s been

re-jiggered, I think you said, right?

A – Jamie Dimon: No. No, no, it was nothing to do with new folks; a little

bit to do with the articles in the press. So it was somewhat related to that.

And it was obviously more than that, but somewhere related to that. And I

also think we acted a little too defensively to that.

—

Q – Mike L. Mayo: And lastly, just one last follow-up. You said you had

some smaller losses in the first quarter. Were there – even in retrospect

were there any signs that perhaps you should have paid more attention to,

looking back?

A – Jamie Dimon: Yes, in retrospect, yes.

Q – Mike L. Mayo: And what would those be?

A – Jamie Dimon: Trading losses.

Q – Mike L. Mayo: Okay, so actually trade…

A – Jamie Dimon: There was some stuff in the newspaper and a bunch of other

stuff.

Translated, the CIO group were out of control and not supervised. J.P. Morgan might have had no clue what was happening at CIO until they read it in the newspaper.

Where Did The Losses Come From?

We know these positions were in derivatives on U.S. corporate bonds (CDX). These were not positions on European bonds, commodities, mortgages or equities.

Dimon said these trading losses were due to the volatile environment. But the environment was not that volatile, certainly not as volatile as 2011. Frankly, nothing special has happened in the corporate bond market in the last month.

So what happened?

Zero Hedge – Is JPM Staring At Another $3 Billion Loss?

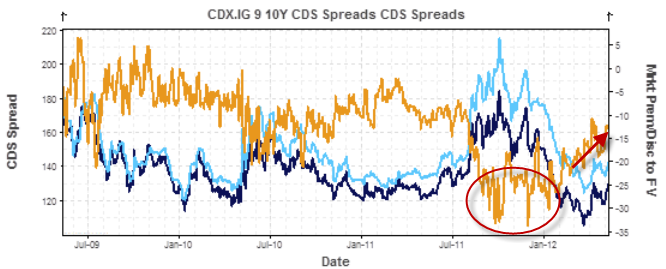

This is the 10Y IG9 credit index (dark blue) and its fair-value (light blue) and the difference or skew (orange). What is clear is that the index remained massively rich to its fair-value through this period (red oval) and it was not until the last two months or so that the skew (red arrow) began to compress as perhaps Iksil got the nod and more and more people realized the arb…(or understood from where the technical pressure was coming in the index rallying)…

In early April, as news of this broke across the market, the credit and equity markets were beginning to quiver again at European contagion and US macro data and as a proxy for the volatility JPM must have been feeling we can see very significant (2-3 sigma) swings in the credit index they held. This would more than likely have triggered a risk manager to come along and look over the trader’s shoulder – suggesting humbly that he exit/hedge/don’t panic.

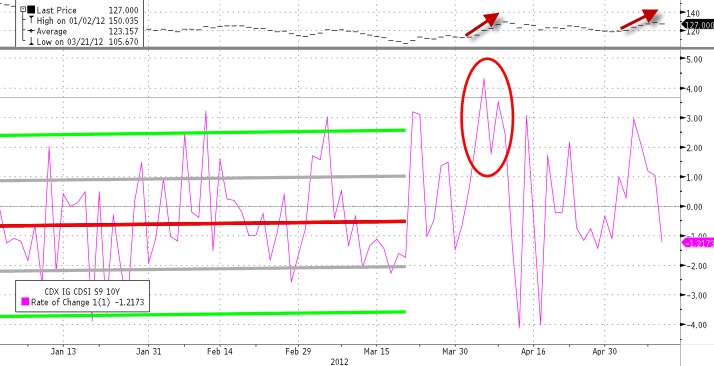

This is IG9 10Y spreads (upper pane) and their rate of change (lower pane) – (h/t @swaptions for idea) and as is clear the 3-sigma multiple day move likely scared a few risk managers (and Iksil) into fessing up…

To translate, the CIO group became so big that they were the market. When J.P. Morgan’s management read about their position sizes and saw potential trouble brewing in credit because of Europe, they shut Iksil down around April 10.

However, shutting down such a large player came with consequences. See the two charts above and notice what happened before and after April 10. The only significant change was J.P. Morgan stopped trading this instrument. In other words, J.P. Morgan’s actions may have caused their own downfall. Furthermore, J.P. Morgan’s continued (in)actions could make the situation worse.

For these types of relatively small market moves to cause a $3 billion loss, J.P. Morgan must have had tremendous exposure.

Dimon also said on the conference call:

We are also amending a disclosure in the first quarter press release about CIO’s VaR, value at risk. We’d shown average VaR at 67. It will now be 129 [chart].

The numbers Dimon cited were averages. The March 30, quarter end VaR was 186. And since much of the loss has occurred since March 30, this VaR could be significantly higher. So yes, their exposure was much higher than they thought.

What Next?

Dimon said on the conference call:

The portfolio still has a lot of risk and volatility going forward. So how are we going to manage that? So, number one, we’re going to manage it to maximize economic value for shareholders. What does that mean? It means that we’re not going to do something stupid. We’re willing to hold as long as necessary inventory, and we’re willing to bear volatility. Therefore, the volatility for the rest of this quarter and next quarter or so will be high. It could cost us as much as $1 billion or more. Obviously, we’re going to work hard to have that not be a negative at all. But it is risky, and it will be for a couple of quarters.

In other words, they still hold these positions and these losses are not finished. Should the market continue to move against them, the losses could grow substantially. In fact, since CIO stopped trading on April 10, normal market relationships have been diverging from historical norms.

More from Zero Hedge:

Of course, the situation is far worse because 1) any efforts to unwind such a huge position will lead to the market yawning wide and swallowing him in illiquid bid-ask spreads; and 2) the rest of the world knows their position – so why would the hedge funds not push their position. Perhaps this explains why JP Morgan’s CDS has remained relatively wide while its exuberant stock price shot up on stress-test ebullience – only to plummet back to CDS reality this evening. Critically, JPM will need to use whatever method they can to hedge this now over-hedged and over-long position – which likely means credit instruments such as JNK, HYG, HY18, and IG18 will all get their share of strange attraction as the trader mispriced not just the basis risk (the volatility between the hedge and its underlying) but the attraction of running with a trend when you have a bottomless pit of money to cover it – until now.

It is already evident in the on-the-run liquid indices – HY18 for instance has exploded wider twice now – in line with the net notional reduction and hedging moves from JPM’s IG9 position…

Translated, CIO had been trying to hedge using the “on-the-run” series 18 CDX (CDX are issued every six months with the latest being series 18). This alone has caused a divergence in normal historical market relationships. Now that the world knows J.P. Morgan’s CIO group is bleeding, hedge funds and other speculators will push these positions to the brink, hoping to force J.P. Morgan out of these positions at a profit to themselves and a bigger loss to CIO.

As the hedge funds push the market against CIO, they will be sitting on an unrealized profit. The problem is they cannot all get out with that profit unless J.P. Morgan is forced out and has to buy the hedge funds’ positions. Since the potential profit involved in this strategy will be huge, the hedge funds will certainly try.

A Final Word About Mr. Bernanke

How was J.P. Morgan able to amass such a large position? If a mere mortal tried this, he or she would have been required to put up ever-larger amounts of collateral with counter-parties that would have effectively stopped the position from getting this big. Since the Federal Reserve proved in 2008 that they would bail out any bank considered too big to fail, no one worries about details like collateral from one of the big banks.

Counter-parties were only too happy to take the other side of J.P. Morgan with little-to-no collateral. They figure that either Mr. Dimon or Mr. Bernanke will honor their contract. The Federal Reserve already set the precedent for such a bailout when it let Goldman Sachs out of its AIG contracts at par. If the markets become too chaotic for J.P. Morgan to handle, the counter-parties are banking on such a bailout once again.

In the days and weeks ahead, the Federal Reserve will no doubt support legislation to stop this scenario from ever happening again. It will not work. The real fix is the same one that has been around for a 1,000 years. It is called capitalism. Let these institutions fail. Tell their creditors they are on their own and push for transparency so everyone can see what banks like J.P. Morgan do. Finally, get out to the way and let the markets fix this problem. This would undoubtedly wreak havoc in the short term, but it will serve as a lesson to everyone in the future that taking such large risks has consequences.

Instead Bernanke will give assurances, hint at more money printing and encourage J.P. Morgan to bury these positions in the hold-to-maturity account where they do not have to be marked to market and we can all pretend they do not exist.

Source: Bianco Research

What's been said:

Discussions found on the web: