Chicago Real Estate Daily – Rents rise again in sizzling downtown apartment market

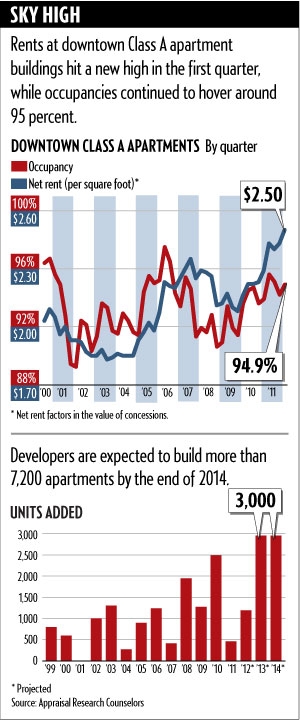

Downtown apartment rents hit another high in the first quarter, and more hikes may be in the offing amid a red-hot rental market. The average effective rent at top-tier, or Class A, downtown apartment buildings rose to $2.50 a square foot in the quarter, up 2.9 percent from the fourth quarter and 9.2 percent from a year earlier, according to Appraisal Research Counselors, a Chicago-based consulting firm. Landlords have been raising rents for more than two years as many people have steered clear of the depressed condominium market and decided to rent instead. Rents at the high end of the downtown market have risen 20.2 percent since bottoming out at the end of 2009; the average Class A apartment costs $2,148 a month today vs. $1,787 back then. The increases are likely to continue until next year, but a construction boom could end that in 2013, when developers add about 3,000 apartments to the downtown market. “Right now, it’s tight,” says Appraisal Research Vice president Ron DeVries. “But when we get into March, April, May of 2013, that’s when things are going to get interesting.”

Comment

Owners’ equivalent rent, or OER, is a measure of housing inflation used by the BLS. They use a survey of rents in an econometric formula to determine housing inflation. This measure has a 32% weight in the calculation of core CPI.

Rents of primary residence, or RPR, is a measure of renters’ inflation used by the BLS. It uses the same survey of rents in a slightly different econometric formula to determine renters’ inflation. This measure has a 8% weight in the calculation of core CPI.

Together OER and RPR are a major driver of core inflation. As the chart below shows, these measures have been moving up over the last several months.

As our colleague Howard Simons noted last month, the recent out-performance of apartment REITS suggests even higher OER in the future. He concluded with:

As the relative REIT indicator is a market-derived measure, its signal of upward pressure on OER over the next three months is preferred to the CPI indicator indicating moderating OER pressure over the next nine months.

Source: Bianco Research

What's been said:

Discussions found on the web: