My afternoon train reading:

• Fed Easing Seems Likely, But of What Form? (Tim Duy’s Fed Watch)

• Risks Rise as Europe’s Banking Ties Fray (WSJ) see also BofA Merrill Lynch Fund Manager Survey Shows Investors Moving out of Equities as Caution Takes Grip (Merrill Media Room)

• How Germans Botched the Spanish Bank Bailout (Bloomberg)

• Significance of 200-day moving average (Market Watch)

• Will BrightScope Clean Up The Financial Services Industry? (Nerd’s Eye View)

• Few Homeowners See Benefit From National Mortgage Settlement, Three Months Later (Huffington Post)

• The Fall of an Electric Empire (Echoes)

• Google’s Android has generated just $550m since 2008, figures suggest (Guardian)

• The (Highly Fictionalized) Zuckerberg Nuptials (NYT Magazine)

• The rise of the gay superhero (The Globe and Mail) I always suspected Batman & Robin had a thing going on . . .

What are you reading?

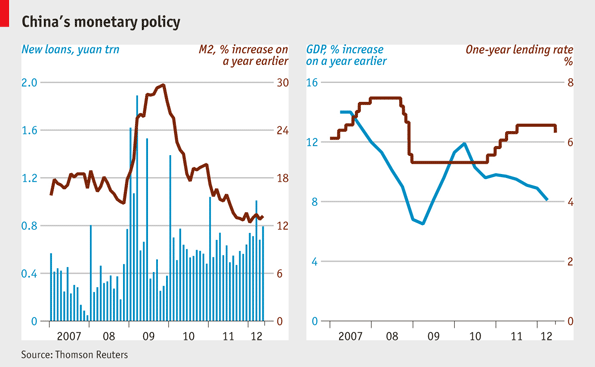

China’s monetary policy

Source: Economist

What's been said:

Discussions found on the web: