My afternoon train reading:

• Members of Congress trade in companies while making laws that affect those same firms (Washington Post)

• Downsized Wall Street licks its wounds (Market Watch) see also The Battle for the Soul of Occupy Wall Street (Rolling Stone)

• Central bank existential crisis confirmed (FT Alaphaville)

• The Most Amazing Bowling Story Ever (D Magazine)

• S&P’s Methods Under Lens (WSJ)

• CTBUH Names Best Tall Buildings for 2012 (Council on Tall Buildings and Urban Habitat) see also Architects And Engineers Say These Are The Most Amazing Tall Buildings Of The Year (Business Insider)

• With Tablet, Microsoft Takes Aim at Hardware Missteps (NYT)

• What facts about the United States do foreigners not believe until they come to America? (Quora)

• The Tale of Emily White, Scarcity and the Future of Music Products (Music Industry Blog)

• Blade Runner: Which predictions have come true? (BBC News)

What are you reading?

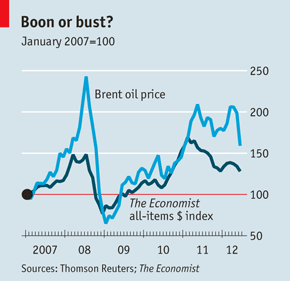

Gas, grains and growth

Source: Economist

What's been said:

Discussions found on the web: