My afternoon train reading:

• Save Us, Ben Bernanke, You’re Our Only Hope (The Atlantic)

• The Liberating Embrace Of Uncertainty (NPR) see also Noise and Signal — Nassim Taleb (Farnam Street)

• Austerity has never worked (Guardian)

• Dr. Gloom mellows but Dr. Doom does not (Market Watch)

• ETFs Are Duking It Out Over Fees (WSJ) see also Aim for the Middle (Aleph Blog)

• Saving on a Rainy Day, Borrowing for a Rainy Day (Nep Dge Blog)

• Princeton Commencement Addresses:

…..-Michael Lewis 2012 Baccalaureate Remarks (Princeton)

…..-Steve Carell 2012 Class Day Remarks (Princeton)

• Is Global Financial Reform Possible? (Project Syndicate)

• How to Backtest Your Trading Strategy Correctly (Trading Markets)

• What Cool Things Can I Do with All This Free Cloud Storage Space? (LifeHacker)

What are you reading?

>

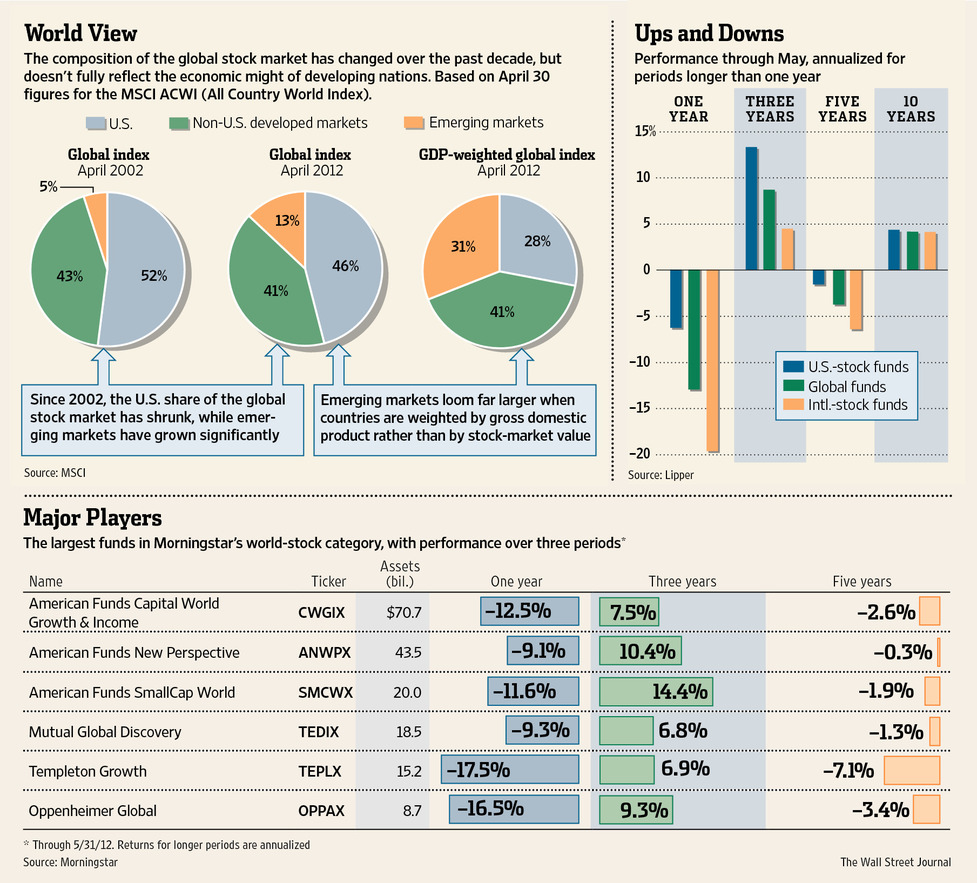

A Smarter Way to Invest Globally?

Source: WSJ

What's been said:

Discussions found on the web: