My afternoon train reading:

• Greek politicians ♥ Spanish bank bailout (FT Alphaville)

• Rating agencies don’t have to lie to be liable (Reuters)

• Time to Embrace Market Risk, or To Run From It? (WSJ) see also Bond Bubble Dismissed as Low Yields Echo Pimco’s New Normal (Bloomberg)

• Farrell: Everything you know about economics is wrong — Why the Myth of Perpetual Growth is killing America (Marketwatch)

• Viewing Financial Crimes as Economic Homicide (DealBook)

• The future of hedge funds (Reuters)

• U.S. government to use ‘drones the size of GOLF BALLS to spy on AMERICAN citizens’ (Mail Online)

• Murdoch demanded I change policy: John Major (AFP)

• Dr. Seuss does Star Wars (Art, son of Adam!)

• The Beatles’ first visit to EMI, part 1 (OUP Blog)

What are you reading?

>

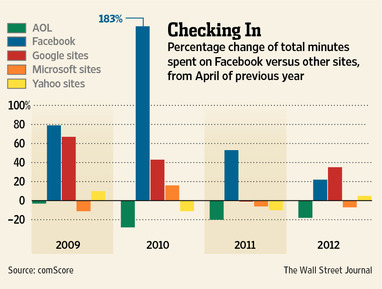

Days of Wild User Growth Appear Over at Facebook

Source: WSJ

What's been said:

Discussions found on the web: