Covering the waterfront of some recent economic and political matters, herewith some thoughts as you prepare to enjoy your summer’s first Bloody Mary:

I’ve still not seen a supply side response to this wonderful piece by Mark Dow. If anyone has, please drop a link in comments.

President Obama was excoriated recently for his clearly inappropriate comment that “the private sector is fine.” Of course, the private sector is not fine, nor will it be until we’re consistently printing ~200K/month or more nonfarm jobs. To be fair, though, the comment for which Obama was ridiculed was taken a bit out of context. In context, it was really a comparison of the private sector to the public sector:

The private sector is doing fine. Where we’re seeing weaknesses in our economy have to do with state and local government — oftentimes, cuts initiated by governors or mayors who are not getting the kind of help that they have in the past from the federal government and who don’t have the same kind of flexibility as the federal government in dealing with fewer revenues coming in.

On that score, he is exactly right. Let’s take a look, shall we, at what the president is referring to.

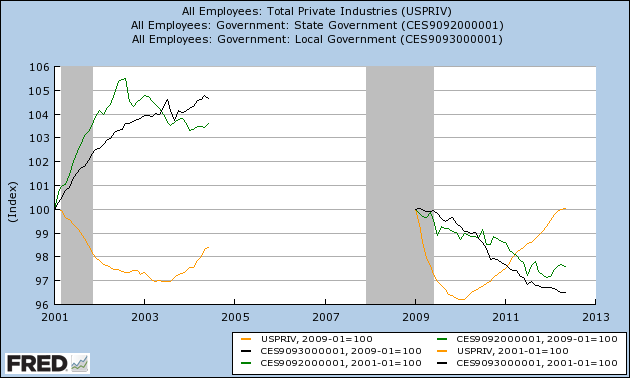

What we’ve got above is State (green) and Local (black) jobs, indexed to 100 at January 2001 and January 2009 – the inaugural months of our past two presidents. Also, for the record – and I’ve written about this before – are private sector jobs (gold), which have grown better in this recovery than in the previous one.

Let’s attach some numbers to the chart beyond the percentage change up or down from 100.

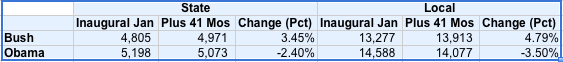

(Source: St. Louis Fed, author calculations. Thousands of persons.)

So, where Bush had picked up 800,000 State and Local jobs in the first 41 months of his term, Obama has presided over a loss of 636,000. (On a Federal level – which is by far the smallest of the three public sectors – Obama has added a whopping 34,000 jobs, whereas at this point in his first term Bush had shed 21,000.) These lost jobs are our teachers, firefighters, police and other civil servants. This is what austerity looks like. (Mind you, I don’t recall seeing anyone lambasting Bush for public sector job growth on his watch.)

Obama has simply not presided over a massive expansion of government, in terms of either spending or hiring. Arthur Laffer and Stephen Moore wrote an op-ed in the WSJ titled Obama’s Real Spending Record. In it, they used the following chart to demonstrate what a big spender Obama is. Seriously, they did. The beauty of it was the mental gymnastics they went through to convince their readership to ignore the actual decline in spending we’ve seen for the past 2+ years. See that (very inconvenient) red line moving down and to the right? And they used that chart anyway. Mind bending – I actually could have used their chart in my May piece demonstrating Obama’s relative frugality. To their credit, though, they do get one thing right: “Sadly for fiscal conservatives, the biggest surge in government spending came during the last two years of President George W. Bush’s eight years in office (2007-2008).” As an aside, since they were kind enough to run the chart starting in 1990, can we discuss for a moment who presided over a decline in Federal government expenditures as a percent of GDP and left his successor with a pretty damn good looking balance sheet? To my untrained eye, it appears as though spending really only declines under Democratic administrations.

Moving on, Census recently released an interesting report titled Sharing a Household: Household Composition and Economic Well-Being: 2007–2010 [PDF], which examines the incidence of “doubling up” from 2007 – 2010. The results are, on the one hand, distressing, but on the other hand offer a glimmer of hope for the housing market and, by extension, economy overall. The statistics about the growth of doubling up are indeed troubling. However, we should consider that (hopefully) at some point these individuals will find their way into their own residence. For example: “The number of adults aged 25 to 34 who lived in someone else’s household increased by 18.1 percent, while the number aged 35 to 64 increased by 9.7 percent between 2007 and 2010. The 1.5 million increase in the number of additional adults aged 25 to 34 accounted for about 45 percent of the total increase in additional adults during the period.” At some point, should this economy ever truly gain some traction and hit escape velocity, I’ve got to believe these interlopers are going to head for the exits of the homes in which they’re now doubled up, and that could be a decent tailwind for an improving housing market.

On Bernanke watch, the Fed’s “central tendency” forecast for the unemployment rate in 2014, released on Wednesday after the FOMC decision, showed them ratcheting up from a range of 6.7 – 7.4 percent to 7.0 – 7.7 percent. The Fed has consistently issued rosy forecast after rosy forecast, only to have to downgrade them at a later date. Given the repeated downgrades, it is shameful that they are not doing more. And at this point, as we draw ever nearer to the election, any further action will draw shrill cries of an attempt to help Obama’s reelection chances. So as not to heap all the blame on Bernanke, I’ve rarely – if ever – seen a more useless group of people than our Congress. Though I don’t think Bernanke’s done enough, he looks downright heroic compared to our do-nothing Congress, which has done exactly zero. And that is simply unforgivable. The Fed’s toolbox is limited to whatever monetary tricks Bernanke can pull out of it. Congress could, if anyone ever found a spine, complement Bernanke’s actions with some growth-promoting legislation. And Mila Kunis is going to fall madly in love with me.

@TBPInvictus

Adding: I’m fascinated that everyone seems to want to jump on the Laffer/Moore graph and my comments about it. That part of the post was almost an afterthought. I’m surprised – though I guess I shouldn’t be – that no one seems to want to tackle the meat of the issue here which is, of course, the first chart of State/Local employment vs. private sector. Then again, what is there to say?

What's been said:

Discussions found on the web: