Kudos to Bloomberg’s Dave Wilson for spotting this study last week by Duke University Professor Campbell R. Harvey and his collaborator, Claude B. Erb. They discovered that “Gold’s prospects are less dependent on inflation than on demand from emerging markets.”

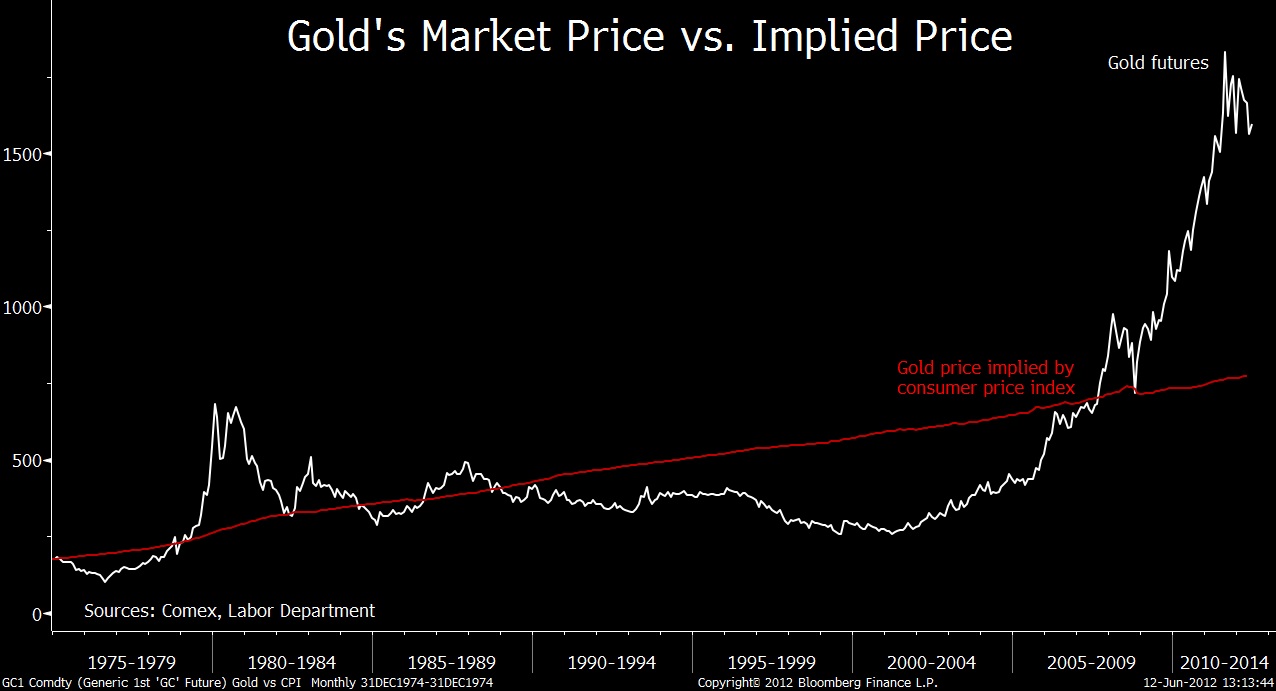

As the chart above shows,

“The relationship between gold and the U.S. consumer price index [was set in 1975] when futures on the metal began trading. The inflation gauge was set equal to the gold price as the period began.

Assuming that gold moved in lockstep with the CPI, the implied price would be about $780 an ounce, according to . Yesterday’s price on the Comex in New York, $1,596.80 an ounce, was more than twice that number.

“If gold is an inflation hedge, then on average its real return should be zero,” Erb and Harvey wrote. Instead, returns from 2000 through March of this year averaged 13 percent a year on an inflation-adjusted basis.

The good news for the Gold ug community is that “Emerging markets are in a position to sustain the surge” because gold is such a relatively small portion of EM central-bank reserves versus the U.S. and other developed countries. To match US holdings relative to GDP, Brazil, Russia, India and China need to raise their gold reserves by 153%.

Source:

Study SHows that Gold is Not Driven by Inflation, but rather Emerging Markets

David Wilson

Bloomberg, June 12, 2012

What's been said:

Discussions found on the web: