Ever since the Robo-Signing scandal erupted in October 2010, banks slowly come to realize that their practices were under ever increasing scrutiny. (I know that’s a Duh! observation for most people, but these are bankers we are discussing).

By early 2011, many of the major money center banks had slowed down their normal foreclosure machinery in a belated attempt to figure out just WTF they were doing internally. There was an attempt to identify the normal processing of defaulted mortgages and see if there was any illegal chicanery going on.

They should have asked the question in the opposite way, as in “Are we doing anything legally?”

As it turned out, an army of outside law firms and 3rd party vendors had by and large run roughshod over the existing laws and legal practices. This did not insulate the banks from the fraud; subcontracting business to felons does not insulate your organization from their illegal behavior.

Regardless, I suspect when some smart bank executive somewhere learned how rampant illegal foreclosures had become, they decided to halt the foreclosure machines altogether to clean up their own house. Contrary to appearances, not every banker is an idiot. As it turns out, its mostly the ones in positions of authority.

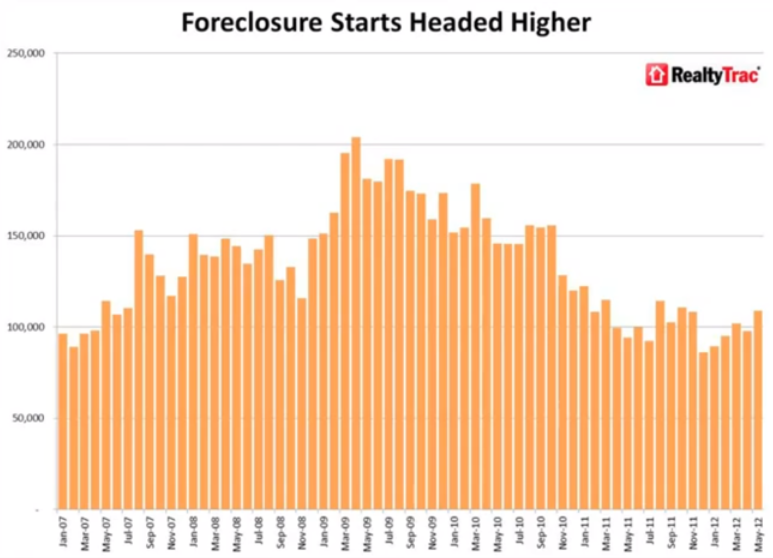

Fast forward to the national robo-signer giveaway settlement. With that now behind them, the voluntary foreclosure abatements have come to an end. Thee was an 18 month period where banks had stopped actively processing these properties. That ended earlier this year. As the creaky, wheezy, inadequate machinery of processing defaulted mortgages rumbles back to life, you would expect to see signs of increasing foreclosures and distressed sales begin any day now.

Cue the RealtyTrac report:

Foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 205,990 U.S. properties in May, an increase of 9 percent from April but still down 4 percent from May 2011.

The details:

-There have been an average of 1.6 million nationwide foreclosure starts per year for the past five years.

-Foreclosure activity rose back up above the 200,000 level in May after two consecutive months below 200,000.

-Foreclosure starts nationwide increased on an annual basis after 27 consecutive months of year-over-year declines.

-Bank repossessions are still down 18% year over year. Voluntary foreclosure freezes and increasing preforeclosure sales are the primary factors reasons.

-Judicial states combined posted a 26% year-over-year increase in overall foreclosure activity while non-judicial states combined posted a 20% year-over-year decrease in foreclosure activity.

-Foreclosure starts increased on a year-over-year basis in 17 of the 26 judicial states and in 16 of the 24 non-judicial states.

Banks seem to be getting religion about doing more distressed/short sales than outright foreclosures, as they generate higher priced sales — meaning a greater recovery for the lender, and less of a writedown:

-Higher percentages of new foreclosures are likely end up as short sales or auction sales to third parties (rather than bank repossessions).

-Pre-foreclosure sales have less of a negative impact on home values than bank-owned sales, they still represent a discounted sale where a distressed homeowner is losing his or her home

-Average price of a pre-foreclosure home was more than $27,000 higher than the average price of a bank-owned home.

One last surprising factoid: Georgia now leads the nation with the highest state foreclosure rate (per capita) versus the next 4 states: Arizona, Florida, California and Nevada. Georgia’s foreclosure rate has not ranked highest in the country February 2006.

click for larger chart

more graphics after the jump

Source:

U.S. Foreclosure Activity Increases 9 Percent in May

RealtyTrac June 14, 2012

http://www.realtytrac.com/content/foreclosure-market-report/may-2012-us-foreclosure-market-report-7238

What's been said:

Discussions found on the web: