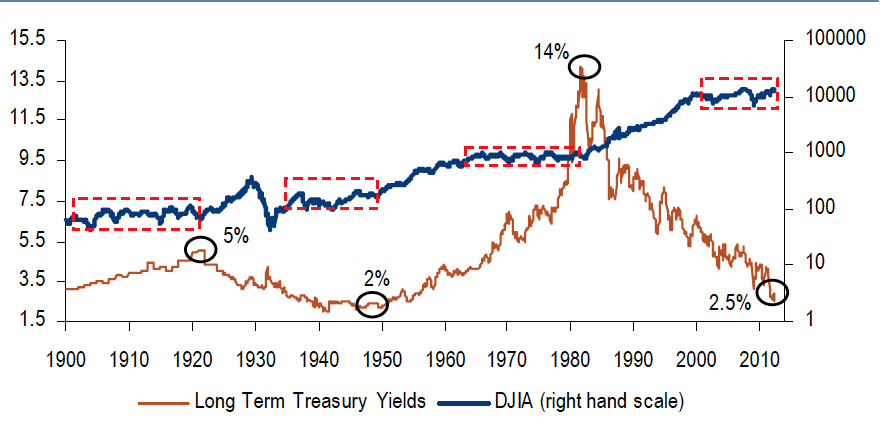

Equity prices & bond yields since 1900

I don’t often give props to big Sell Side firms, but today I must make an exception. Merrill Lynch’s Equity Strategy group put out The Longest Pictures: Picture Guide to Financial Markets Since 1800 this week. Its a 102 page doozy looking at every asset class and country going back through the history of time. It illustrates a variety of long-run trends in financial markets.

The chart above shows equities in their 4th secular trading range — aka Bear market — while bonds are enjoying their 2nd great secular bull market of the past 110 years.

I am in concurrence with this perspective:

“We nonetheless remain of the view that the catalyst for a decisive change in secular market leadership (or “Great Rotation”) awaits a “good” bear market in bonds caused by real estate, labor and banking markets ending the current Era of Deleveraging.”

In other words, until this secular bear market ends — perhaps with the Bond market cracking — expect contained equity markets and modest returns.

I cannot give out their copyrighted work, but you should definitely get your hand on this if you can (surely you know someone who works at BofA/Merrill?).

Nicely done.

Source:

The Longest Pictures

Michael Hartnett, Chief Global Equity Strategist

BofA Merrill Lynch 27 June 2012

What's been said:

Discussions found on the web: