Some reads for a gorgeous Sunday morning:

• Big Investors Don’t Know Where to Put Their Cash (Spiegel.de)

• JPMorgan: If This Is a Financial Fortress, Run For the Bunkers (Alter Net)

• ‘Facebook Funds’ Plunge (WSJ)

• Pimco’s Home-Loan Wager Seen as Prescient on QE3 Odds (Bloomberg)

• U.S. debt load falling at fastest pace since 1950s (Yahoo Finance)

• Prosecute The Big Banks? ‘Nothing’s Off The Table,’ NY Attorney General Says (TPM) see also Big U.S. Banks Brace for Downgrades (WSJ)

• Trustee Sees Customers Trampled at MF Global (NYT)

• Steve Levitt: Like a True Chicago Boy, Likes People to Go to Jail so Markets Can Be Free (Naked Capitalism)

• Did Republicans deliberately crash the US economy? (Guardian)

• Book Review: A Bank on the Run: How WaMu’s Demise Hit Home (WSJ)

What are you reading?

>

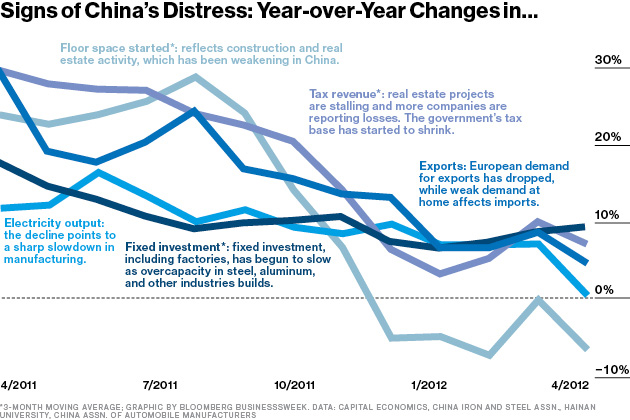

China Slowdown?

Source: Businessweekp://www.businessweek.com/articles/2012-05-31/understanding-the-china-slowdown” target=”_blank”>Businessweek

What's been said:

Discussions found on the web: