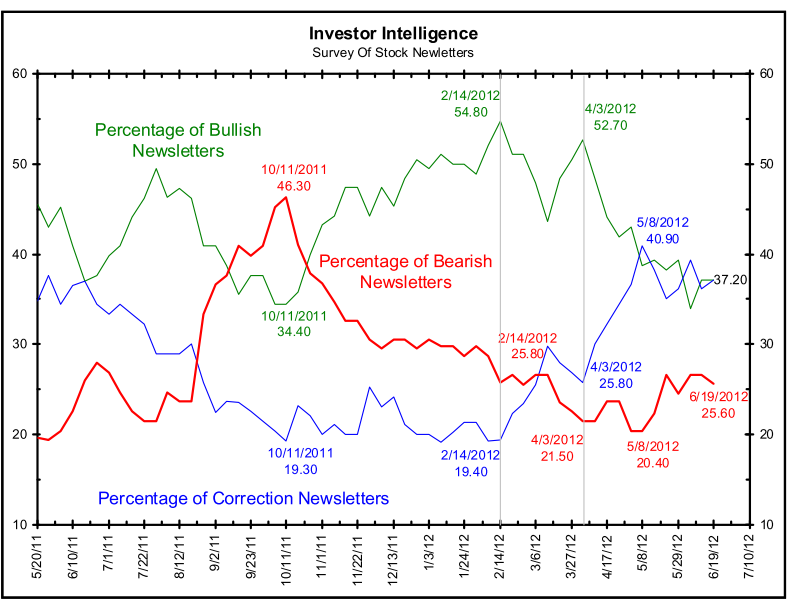

As the chart above shows, the percentage of bears (in red) has not risen. It remains at the same level it was when bullish sentiment peaked.

As noted here, there is widespread expectations that the Fed will eventually intervene if the markets drop to far.

The Bernanke Put is alive and well . . .

What's been said:

Discussions found on the web: