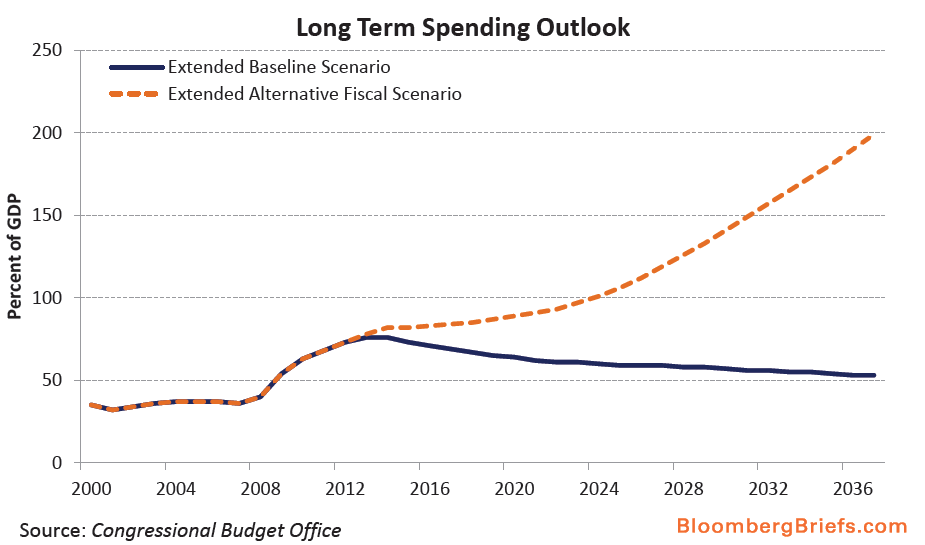

Fiscal gridlock in Washington has resulted in the deterioration of the nation’s long term budget outlook. Based on data published by the Congressional Budget Office, should spending and revenues not be brought into alignment over the next several years, the fiscal drag on the economy will reach the point where it will become a long-term weight on overall growth, likely resulting in higher interest rates and funding problems for government-issued debt.

While a U.S. funding crisis may be years away, the near-term inability of policy makers to agree on appropriate levels of spending and taxes is at the core of the dispute that has resulted in an unusual confluence of expiring policies on January 1, 2013. Unless an agreement to extend these policies is reached, the net impact on the economy will amount to a “fiscal cliff” of almost $560 billion, or 4 percent of gross domestic product. The ability, or lack thereof, of policy makers to arrive at a decision will shape the long-term budget picture of the U.S. Based on research by Carmen Reinhart and Kenneth Rogoff, once a nation’s debtto-GDP ratio exceeds 90 percent, it exerts a drag of 1 percent on growth annually.

Under the CBO’s long-term baseline scenario, U.S. debt-to-GDP ratio will likely decline to 61 percent in 2022 from 73 percent currently, and to 53 percent in 2037. The alternative scenario – if the nation’s fiscal path is not put on a more sustainable footing – the debt-to-GDP ratio will increase to 93 percent in 2022 and roughly 200 percent by 2037. To put this in perspective, the CBO’s alternative scenario indicates that net interest on the federal debt will exceed spending on Social Security in as little as 12 years.

That scenario is quite grim; the reality may be worse. The CBO assumes that the real annual interest rate on the 10-year Treasury note will be 3 percent, and the real annual interest rate on federal debt held by the public will be 2.7 percent. While those rates are well above the prevailing 1.63 percent, those assumptions are likely to prove optimistic given the current path of federal spending and the general inaction on the part of policy makers to increase revenues or pare back long-term spending commitments.

The 40-year average national tax rate is a little more than 18 percent. While as recently as the mid 1990’s it has been higher than that, the rapid expansion of spending in the wake of the Great Recession, and the subdued tax revenues that followed it, exacerbated the imbalance between revenues and spending. The result is government spending likely to exceed 25 percent of overall growth in fiscal year 2012. Based on the past two decades, the public has expressed a preference for lower taxation while simultaneously maintaining high levels of benefits. Unless that preference structure changes, it will necessitate reduced levels of entitlement spending which may exacerbate the sharp policy divide in Washington.

That policy divide underlies the nearterm risks associated with the economy hitting the fiscal cliff in 2013, and the longterm damage to the economic outlook from the mis-alignment between revenues and federal spending.

Click to enlarge:

˜˜˜

Source:

Bloomberg BRIEF

June 7, 2012

What's been said:

Discussions found on the web: