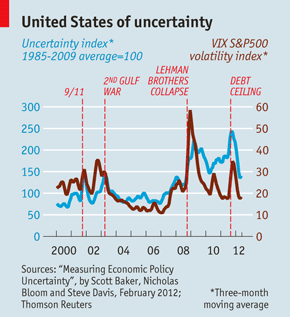

No sooner does this morning’s “Uncertainty” piece go up when someone emails me this “quantified” version of uncertainty.

The claim is made that “Nick Bloom and Scott Baker of Stanford University and Steve Davis of the University of Chicago” have figured out how to measure uncertainty:

Sadly, no.

This is merely an index of how often uncertainty (related to policy) gets mentioned in newspapers. They also include other elements (number of temporary provisions in tax codes and variance in inflation and federal spending forecasts).

Note how much uncertainty there was in 2000 and 2007 — periods of low uncertainty where investors were not rewarded for the risk they took . . .

What's been said:

Discussions found on the web: