>

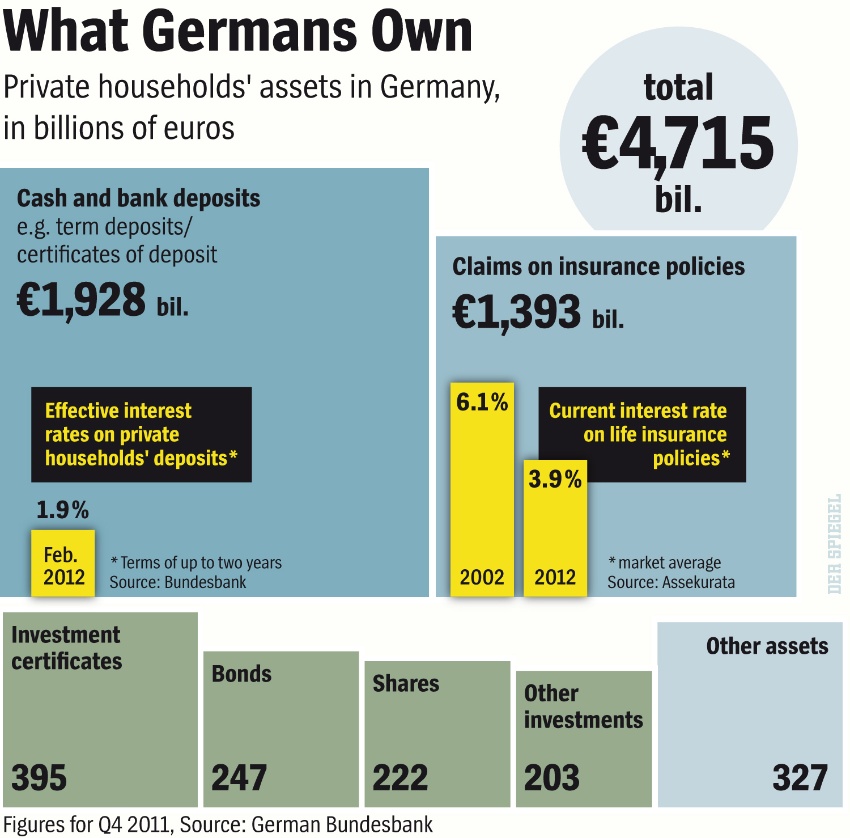

I mentioned this de Spiegel article in the reads, but I found this graphic quite fascinating, having nothing whatsoever to do with the fact my last name is Ritholtz or I have a business trip to Berlin next month.

>

Source:

Crisis Pushes Down Returns Big Investors Don’t Know Where to Put Their Cash

Sven Böll and Martin Hesse

De Spiegel 06/05/2012

http://www.spiegel.de/international/business/institutional-investors-desperately-seek-investment-opportunities-a-836975.html

What's been said:

Discussions found on the web: