I was surprised at some of the pushback to Invictus’ post, Austerity At Work yesterday — at least when it comes to the data portion. The number of state, local and federal layoffs is well documents.

Here is the WSJ:

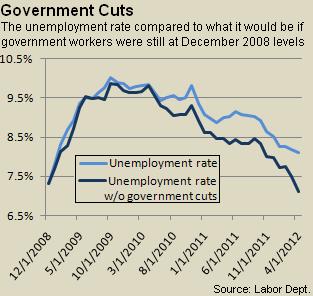

One reason the unemployment rate may have remained persistently high: The sharp cuts in state and local government spending in the wake of the 2008 financial crisis, and the layoffs those cuts wrought.

The Labor Department’s establishment survey of employers — the jobs count that it bases its payroll figures on — shows that the government has been steadily shedding workers since the crisis struck, with 586,000 fewer jobs than in December 2008. Friday’s employment report showed the cuts continued in April, with 15,000 government jobs lost.

This is not politics, but simple numbers. Sorry if it conflicts with your previously assumed narrative . . .

Source:

Unemployment Rate Without Government Cuts: 7.1%

Justin Lahart

WSJ, May 8, 2012,

http://blogs.wsj.com/economics/2012/05/08/unemployment-rate-without-government-cuts-7-1/

What's been said:

Discussions found on the web: