My morning reads:

• Why the USA is the Comeback Kid (Economist)

• Americans Living Larger As New-Home Sizes Defy Economy (Bloomberg) see also Housing groups accuse DOJ of ‘stonewalling’ mortgage fraud cases (Reuters)

• Why Investors Shouldn’t Count on QE3 (Yahoo Finance)

• The Hole in the Bucket (Washington Monthly) see also Moneyballing the Financial World (Motley Fool)

• George Soros’ Best Investment Advice (Market Folly)

• China’s ‘5 apocalypses’ signal global recession (Market Watch) see also Just How Bad Are Things in the Middle Kingdom? (WSJ)

• The Mystery of John Roberts (NYT)

• Fighting words: Apple’s ‘Post-PC’ and Microsoft’s ‘PC Plus’ were never that different (The Verge)

• Relativistic Baseball (What If)

• The Rolling Stones Have Been A Band For Fifty Years (The Awl)

What are you reading?

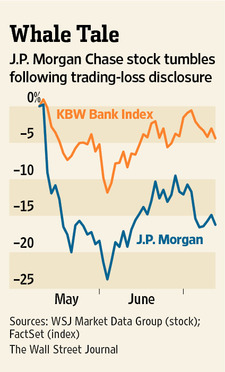

At J.P. Morgan, Whale & Co. Go

Source: WSJ

What's been said:

Discussions found on the web: