My morning pre-crash reads:

• Berlin, IMF To Refuse Fresh Aid for Greece (Spiegel.de) see also Spiegel bombshell: The IMF plans to dump Greece (The Automatic Earth)

• China Central Bank Adviser Forecasts Growth Slowdown to 7.4% (Bloomberg)

• Open Season on Wall Street Jobs (Businessweek)

• Hedge Fund Places Faith in Euro Zone (NYT)

• U.S. Cities Get Fleeced in Libor Scandal (The Fiscal Times) see also Banks in Libor probe consider group settlement-sources (Reuters)

• Bungled Bank Bailout Leaves Behind Righteous Anger (Bloomberg)

• The Top American Science Questions in 2012 (Science Debate)

• Political Perceptions: Campaigns Grow Louder as Pool of Converts Shrinks (WSJ)

• Corruption allegations, major fraud inquiries, a senate probe into deals with drug-running gangsters in Mexico … and a luxury yacht. Welcome to the world of banking 2012 (Herald Scotland)

• Google’s Data Advantage Over Apple’s Siri (NYT)

What are you unloading?

>

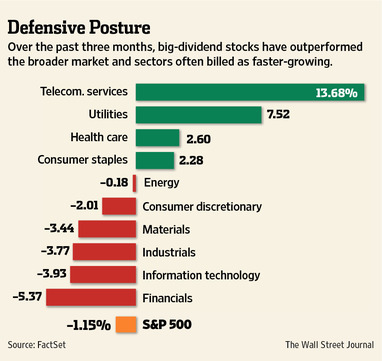

Investors Testing Limits of Defense

Source: WSJ

What's been said:

Discussions found on the web: