My afternoon train reading:

• Wall Street Is Too Big to Regulate (NYT) Make it smaller

• 450-year-old debt. Trillions owed. But will German village get repaid? (CS Monitor)

• Study Finds About 20% of US Public Companies Cheat On Earnings Reports (Jesse’s Café Américain)

• Klarman vs Tilson (The Reformed Broker) see also The Oracle of Boston (Economist)

• In California city, mixed picture of life after bankruptcy (SF Gate)

• Extraordinary Strains (Hussman Funds) see also Treasury Yields Drop to Records in Safe Haven Bid (Bloomberg)

• Austerity’s Big Winners Prove To Be Wall Street And The Wealthy (Huff Post)

• Microspheres Could Save Patients Whose Lungs Have Stopped Working (Technology Review) see also Breathing an idea to life: Injectable oxygen microparticles (Vector)

• No, the web is not driving us mad (Mind Hacks)

• How I lost my fear of Universal Health Care (A Young Mom’s Musings)

What are you reading?

>

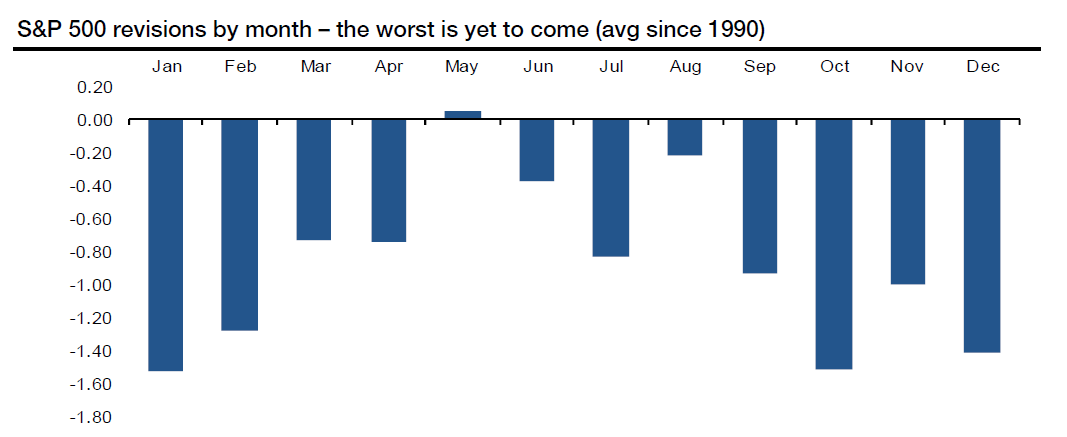

Recent earnings slump is just a dress rehearsal

Source: Societe General

What's been said:

Discussions found on the web: