Nearly 70% of Americans say cutting the deficit is an important goal for 2012, with 84% Republicans, 66% Democrats, and 64% Independents rating it as their top priority.

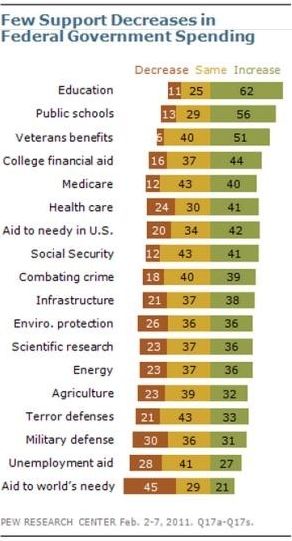

These folks are happy to slash spending and raise taxes — only theoretically. Asked about specific programs, wide majorities almost always favor either increasing spending or maintaining the current level, as the following chart from Pew shows:

Source: Think Progress

On education, for instance, 62 percent favor increases and 25 percent favor maintaining the current level. More than 90 percent favor either an increased level or the current level of spending on veteran’s benefits; and more than 80 percent favor increasing levels or maintaining the current level on college financial aid, public school spending, Medicare, and Social Security. The only program that even gains a plurality of support for reduced spending levels is aid to the world’s needy

What's been said:

Discussions found on the web: