Claims of a housing recovery and price bottoming have been greatly exaggerated, according to Radar Logic’s May 2012 RPX Monthly Housing Market Report.

Michael Feder, Radar Logic’s CEO, observed “Those people looking at current results and calling a bottom are being dangerously short sighted. Not only are the immediate signs inconclusive, but the broad dynamics are still quite scary. We think housing is still a short.”

On a month-over-month and year-over-year basis, the RPX Composite price rose 2.6% and 0.7%, respectively. Home prices have exhibited more strength to date in 2012 than they have over the same period in the preceding three years.

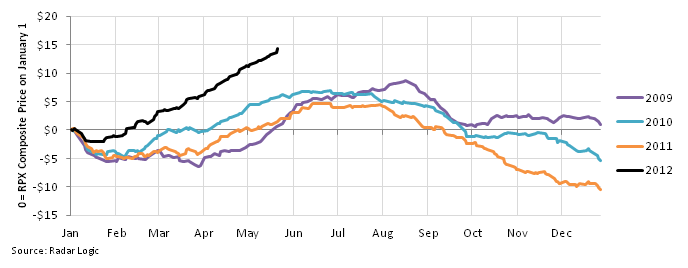

As shown in Exhibit 1 (below), the RPX Composite price increased $14.27 (8.3 percent) from the beginning of 2012 through May 23, much more than the increases during the same period in 2009, 2010 and 2011.

Key observations from the May 2012 RPX Monthly Housing Market Report:

• Evidence that the housing market has bottomed is not conclusive;

• Data from the second half of the year tells more about price trends than data from the first half;

• Reports of diminishing supply are greatly exaggerated;

• Psychology and total inventory – including both “visible” and “shadow” inventory suggest housing is a short.

This viewpoint remains the minority perspective. (see yesterday’s Deleveraging 30 Million Units).

Change in RPX Composite Price from Beginning of Year, 2009-2012

With respect to house prices, thanks to QE2 and Operation Twist the Fed has driven mortgage rates 150 bps lower. According to Mark Hanson, this “has resulted in a YoY increase in purchasing of more than 15% for the 72% of buyers who use a mortgage to purchase.

Add to this the large drop in the percentage of distressed homes of real estate sales. These typically sell for 20-30% lower than non-distressed properties. As we previously discussed, this decrease is due to the voluntary foreclosure abatements.

Meantime, the healthiest segment of the Housing market remains the high end properties. (Yes, it is true, the 1% are still doing okay). Hence, the mix of homes that are being sold is now skewed away from the cheapest properties.

Thus, what people are mistakenly perceiving as YoY house price “appreciation” are a combination of these factors: Less distressed properties, lower mortgage rates, and increased purchasing power.

Mark Hanson argues that given house prices are established through comparable “sales” (versus the same home) and that on a YoY normalized basis, these have failed to keep up with the increase in purchase power. Hanson notes there is no real difference between the YoY “resetting” of rates lower and introducing increased leverage to keep people paying “more” for houses, despite the same income and monthly payment.

In other words, Hanson writes, real home prices are actually lower.

As we have said previously, our current RRE situation can be best described as massive Fed stimulus + government induced foreclosure abatements = some stabilization.

What's been said:

Discussions found on the web: