Today’s Housing Bulls are pumped full of antibiotics and steroids, corn fed, genetically modified creatures from a lab. They are not natural; They are not grass fed, free-range, organic Angus cattle. They are unnatural, not found in the wild. These artificial constructs are a joint project of Congress and the Attorney General’s office and the FOMC.

Consider the Case Shiller data — up 2.2% monthly and down 1% year over year — disappointed slightly. But to really understand where Housing is in the cycle, we need to do more than merely look at the chart; we needs to put those data points into broader context. We need to imagine what an organic housing sector would look like versus the Frankenstein creature we have today.

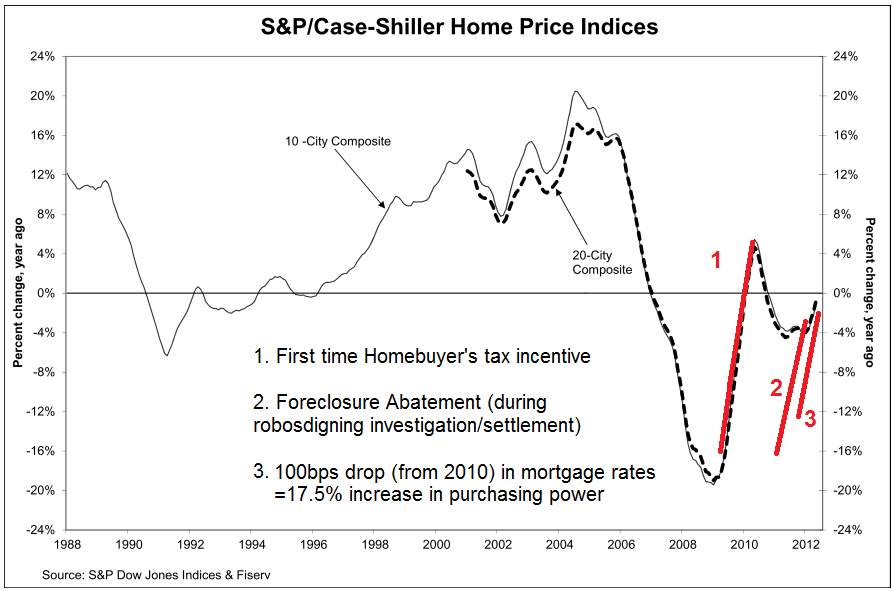

In order to get these flat to negative numbers, an extraordinary amount of firepower has been thrown at Housing:

1. First time home buyers tax credit

2.FOMC QE, Twist, driving mortgage rates down 100+ bps

3.Foreclosure abatements during robosigning

You can see the impact of these efforts reflected in the annotated chart:

>

Contextualizing Case Shiller Housing Data

Non-annotated origianl Case Shiller charts after the jump

Case Shiller:

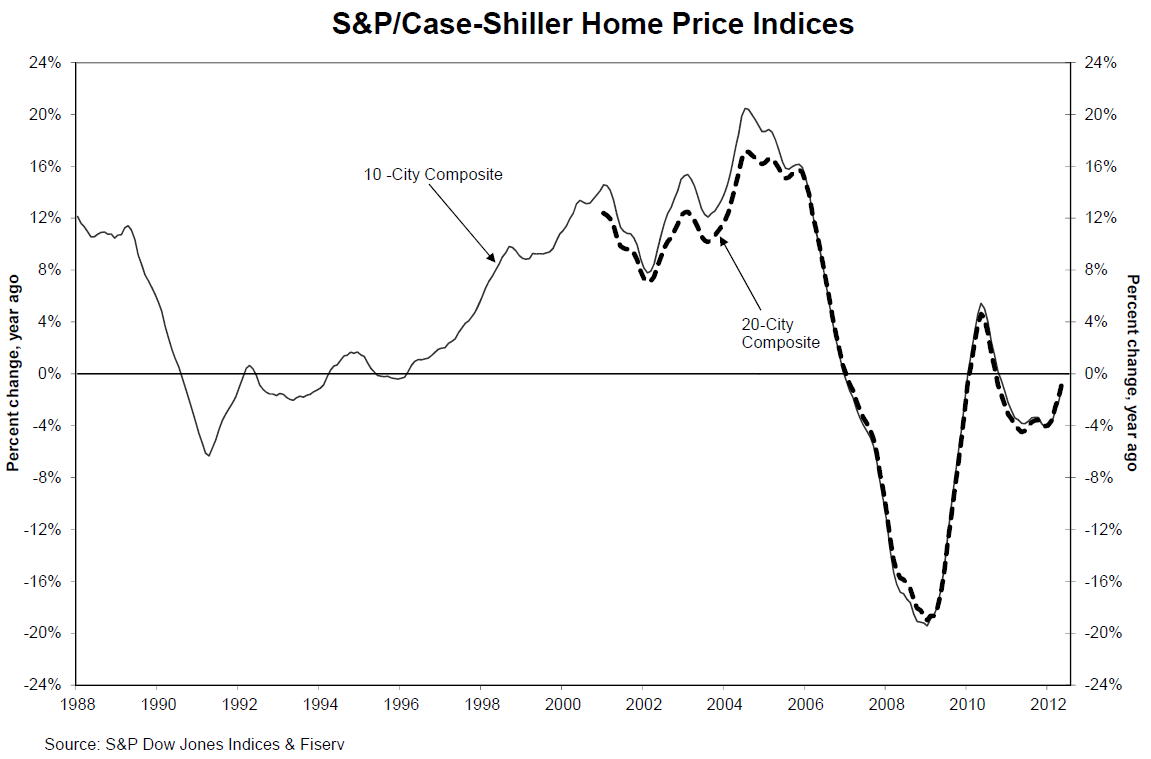

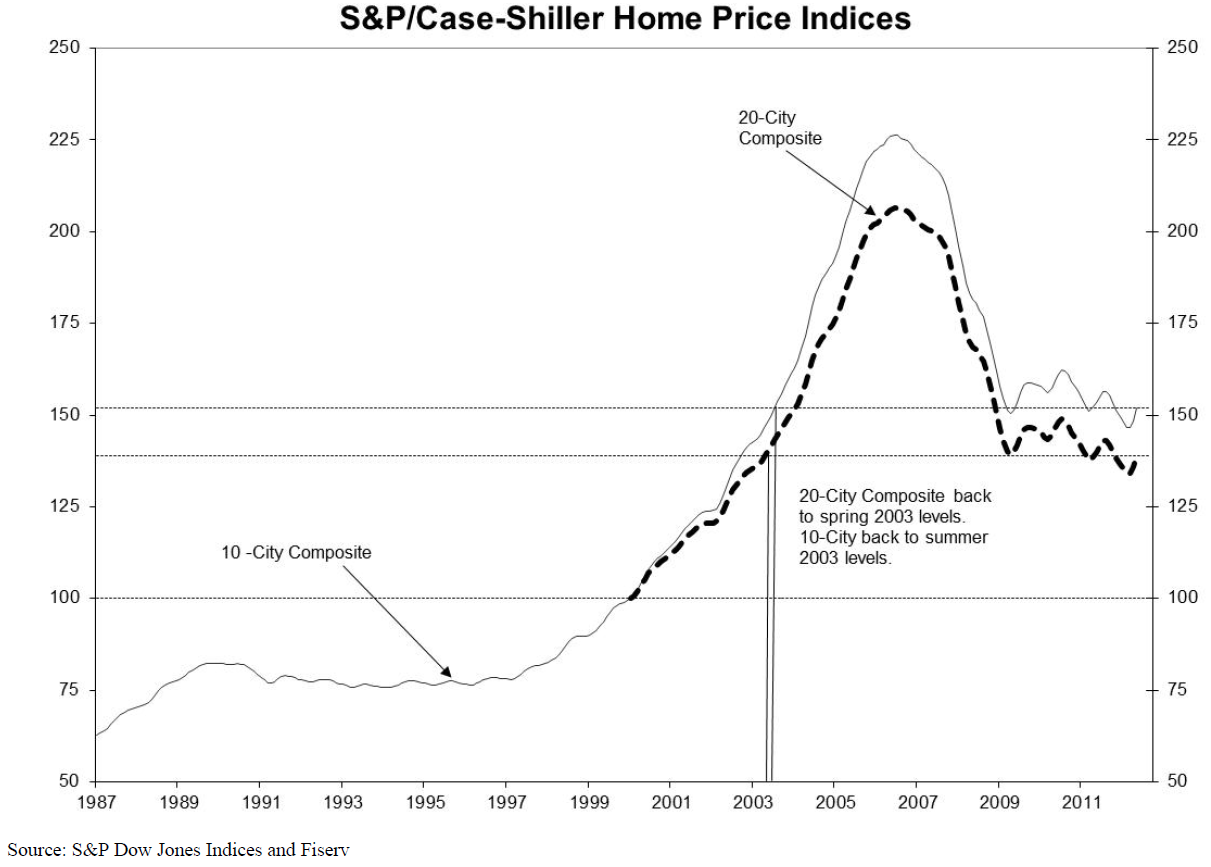

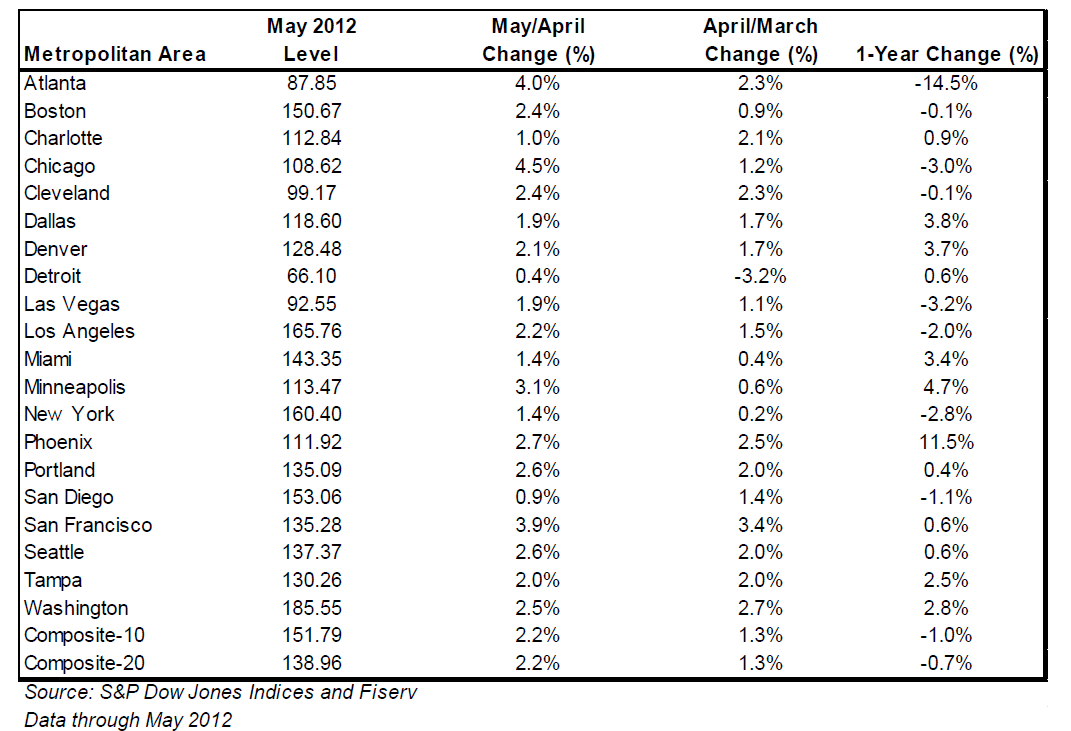

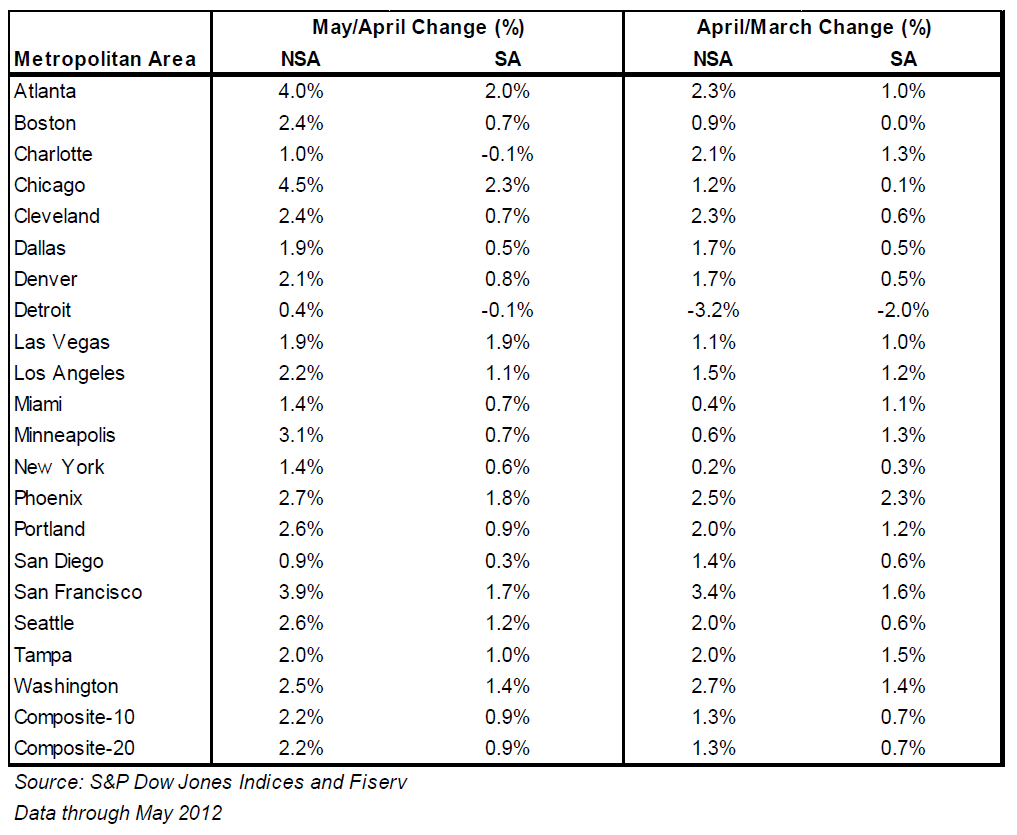

Data through May 2012, released today for S&P/Case-Shiller1 Home Price Indices showed that average home prices increased by 2.2% in May over April for both the 10- and 20-City Composites.

With May’s data, we found that home prices fell annually by 1.0% for the 10-City Composite and by 0.7% for the 20-City Composite versus May 2011. Both Composites and 17 of the 20 MSAs saw increases in annual returns in May compared to April . . . This is an improvement over the -17.0% annual decline recorded in April 2012. All 20 cities and both Composites posted positive monthly returns. No cities posted new lows in May 2012.

˜˜˜

˜˜˜

˜˜˜

Source:

S&P Dow Jones

July 31, 2012

What's been said:

Discussions found on the web: