TOPIC 1: Principal Forgiveness

Proponents of principal forgiveness (for certain underwater homeowners) believe that such government-sponsored programs may help stabilize housing markets while reducing overall losses to mortgage investors and taxpayers. Opponents are mostly concerned that all underwater homeowners (9 out of 10 of whom are keeping up with mortgage payments, according to recent Zillow research) would be provided an added incentive to “strategically default” – thereby creating moral hazard and raising the risk of incurring greater-than-anticipated costs.

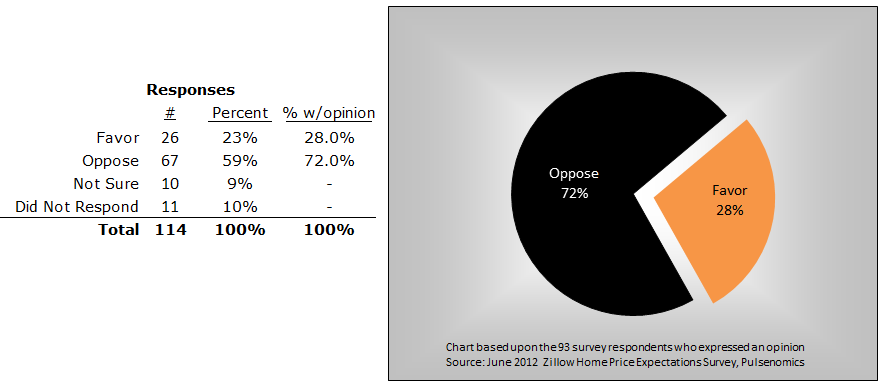

Do you favor or oppose adoption of government-sponsored mortgage principal forgiveness initiatives for certain underwater borrowers?

Click to enlarge:

TOPIC 2: Outlook for the U.S. Homeownership Rate

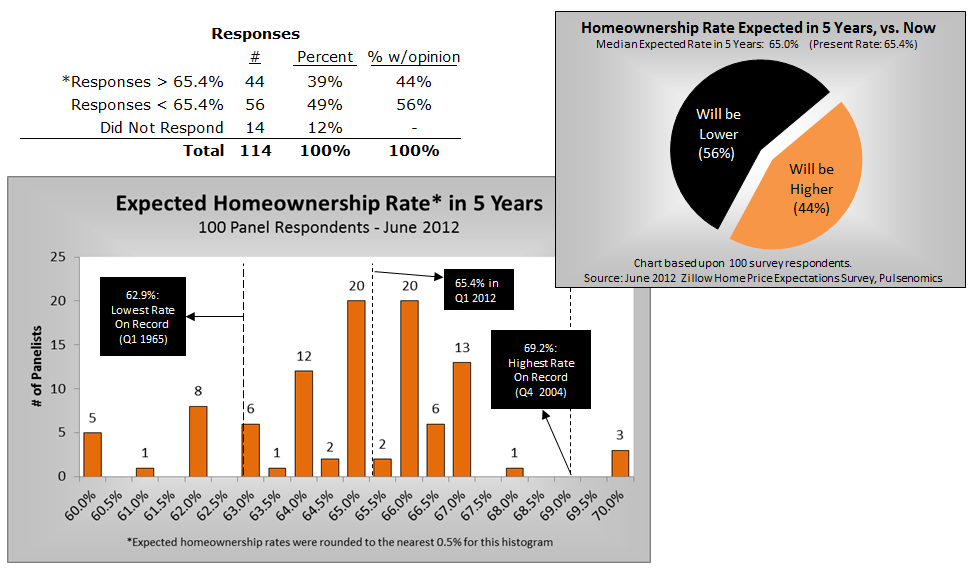

The Census Bureau recently reported that in Q1 2012, the U.S. homeownership rate declined to 65.4%, a 15-year low, and that the rental vacancy rate fell to 8.8%, its lowest level in almost a decade. Some analysts believe that sustained increases in household formations will soon reverse these trends, while others suggest that changing attitudes about homeownership may suppress buyer demand for years to come.

What do you think the homeownership rate will be five years from now?

TOPIC 3: Strategic Default Scenario

The housing bust has some underwater homeowners concluding that their home values will not recover quickly or soon to a level that re-establishes positive equity. Even with the capacity to keep up with their scheduled mortgage payments, some number of these borrowers elect to default based upon “strategic” and/or “economic” analysis of their housing predicament.

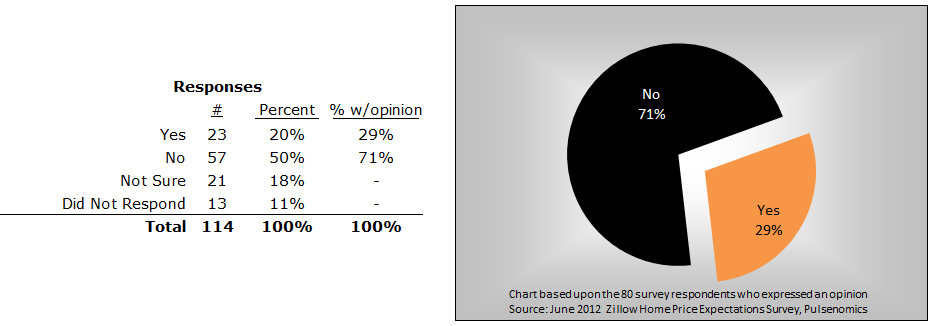

In the interest of understanding how an esteemed panel of strategists, economists, and housing analysts view this issue, consider the following scenario and related question:

– You are a homeowner with strong credit and capacity to pay your mortgage

– The most optimistic long-term outlook for home prices in your local market calls for annual changes within about 1% of CPI

– Your combined outstanding mortgage balances are 140% of your home’s current market value

In this scenario, do you think you would “strategically default” ?

Source: Home Price Expectations Survey. Zillow and Pulsenomics LLC

What's been said:

Discussions found on the web: