Two reports from different wirehouses caught my eye yesterday due to their amazing Yin and Yang nature.

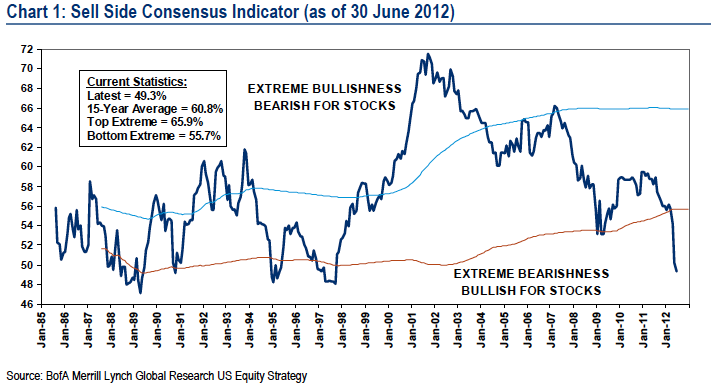

First up, the always excellent Equity & Quant Strategist at BAML, Savita Subramanian (the Yin), issued a report titled Wall St. Proclaims the Death of Equities. The report discusses the firm’s proprietary sell-side indicator, which has reached near record levels of bearishness, which is of course bullish for stocks. So much so that its current level implies a 12-month S&P500 target of 1665. (It should be noted that the indicator’s focus is equity allocation: It “is based on the average recommended equity allocation of Wall Street strategists as of the last business day of each month. We have found that Wall Street’s consensus equity allocation has historically been a reliable contrary indicator.”) Although it’s about equity allocation, bear with me here.

Here’s a look at the chart. (Note that 1665 is not BAML’s official S&P target – it is the implied target based on this one indicator, not the firm’s official position.)

No sooner had I read that report when, lo and behold, I come across a piece of research from UBS’ estimable Chief Strategist Jonathan Golub (the Yang) who, as if on cue, sliced his S&P500 forecast by 100 down to 1375 and shaved $1.50 off his S&P earnings, down to $103.50. (I am, perhaps a bit unfairly, construing Mr. Golub’s call as effectively the equivalent of a reduction in equity allocation. As he’s cut his target by 6.7% and called for the remainder of the year to be flat, I don’t think that’s too much of a stretch.)

Said Mr. Golub:

We are lowering our S&P 500 year-end target to 1,375 from 1,475 on three main catalysts: (1) deterioration in incoming U.S. economic data; (2) the Supreme Court’s healthcare ruling, which we believe will contribute to greater partisanship ahead of year-end fiscal discussions; and (3) a more contentious tone among European policymakers, despite some success at the most recent Euro summit.

We are lowering our S&P 500 earnings estimates for 2012 to $103.50 from $105, and for 2013 to $110 from $113. Our lowered estimates reflect moderate U.S. GDP, weaker non-U.S. growth, additional dollar strength, and a more difficult operating environment for Financials.

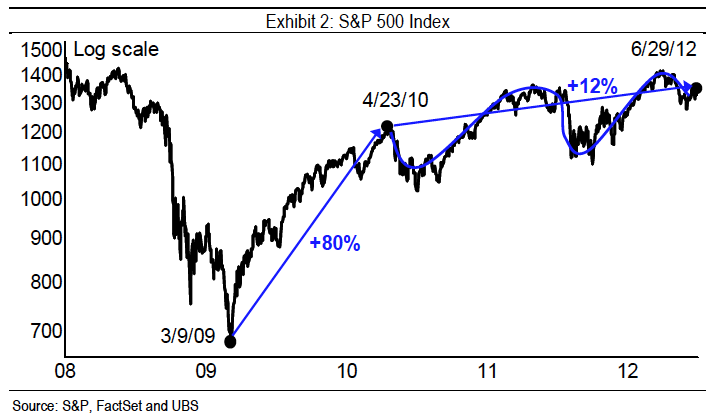

And an interesting chart from Mr. Golub:

As the exhibit below highlights, the vast majority of market’s rebound was achieved in the early days of the recovery as a result of earnings strength and a re-rating of multiples from depressed levels. By contrast, the market’s 12% rise over the past two years has been characterized by flatter returns with greater volatility.

If there’s been a better example of research Yin and Yang, I can’t remember what it was. Fascinating stuff from two great strategists.

Finally, I’ll note that I’m starting to see a real divergence of opinion opening up on where markets are headed, this being the most recent – and obviously glaring – example. It will be interesting to watch it all play out.

Discuss.

@TBPInvictus

What's been said:

Discussions found on the web: