Some morning reads:

• Meaning of weakness in Dow transports (MarketWatch)

• Rally Has People Feeling Better About Stocks (Marketbeat)

• Jonathan Weil: Did We Just Find Someone to Take On the Banks? (Bloomberg)

• Interview: Alan Greenspan on His Fed Legacy and the Economy (BusinessWeek)

• ‘Why Nations Fail’: Can elites choke American prosperity? (CS Monitor)

• Same old nonsense: Arthur Laffer’s Anti-Stimulus Curve Ball is a Foul (Time)

• Yes, College Is Worth It — With Some Caveats (Real Time Economics) see also Commoditized business education comes to Yale; “How can we become as awful as other MBA programs?” new Dean asks (NYT Magazine)

• Craigslist’s Challenger Could Be an App, or Several (NYT)

• What if there was a robot apocalypse? How long would humanity last? (What If)

• iPad Takes Slight Dive, Samsung, Google See Tablet Success in July (Chitika) see also Explaining the iOS and Android mobile browser usage disparity (Salon)

Whats on your agenda for the weekend?

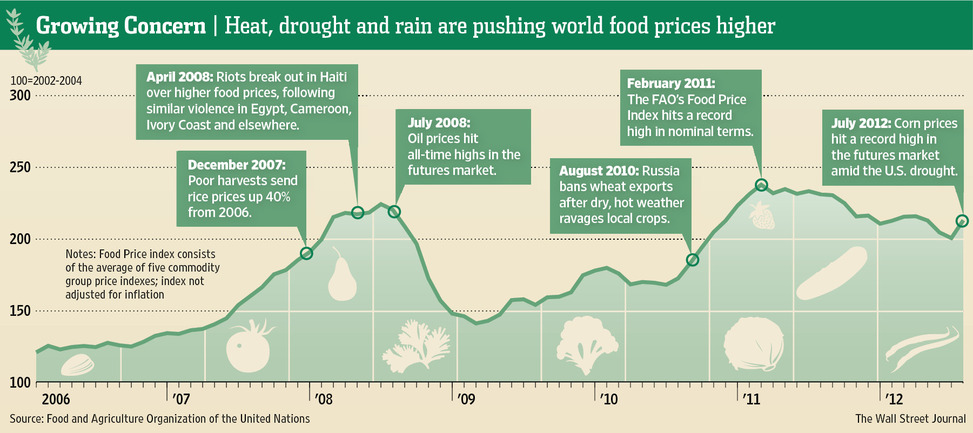

Weather Pushes Up Food Prices

Source: WSJ

What's been said:

Discussions found on the web: