My morning reads:

• The Fear Gauge Goes Quiet—Too Quiet (WSJ) see also Stocks Approach Multiyear Highs (WSJ)

• Derivatives industry no likey new margin requirements (FT.com)

• Is Mark Zuckerberg in over his hoodie as Facebook CEO? (LA Times)

• Neuroeconomics two-fer

…..-Why are people overconfident so often? It’s all about social status (Barkeley HAAS)

…..-Studying Brain Responses Gives Marketers Increased Ability to Predict How People Make Decisions (Barkeley HAAS)

• Quelle Surprise! SEC Plans to Make the World Safer for Fraudsters, Push Through JOBS Act Con-Artist-Friendly Solicitation Rules (Naked Capitalism)

• China and India Lose Their Hunger for Gold (WSJ)

• New rules expose bigger funding gaps for public pensions (Washington Post) see also 11 reasons to leave your 401(k) behind (Market Watch)

• Google: Central Banks’ New Economic Indicator (Businessweek)

• The Single Most Important Object in the Global Economy (Slate)

• Fiscal Cliff Crisis Rooted in Senate Ploy to Pass Bush Tax Cuts (Businessweek)

What are you reading?

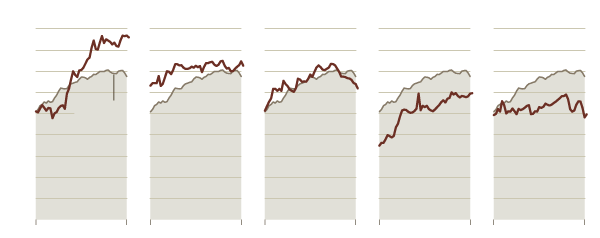

For Europe’s Economy, a Lost Decade Looms

Source: NYT

What's been said:

Discussions found on the web: