My afternoon train reading:

• Happy Lost Half Decade, America! Just How Japanese Do We Look? (MarketBeat)

• Pay you 2 & 20 for what?!? Paulson Steps Up Gold Bet to 44% of Firm’s Equity Assets (Bloomberg) see also Why Hedge Funds Destroy Investor Wealth (Advisor Perspectives)

• Trickle-Down Fairy Dust (Economix)

• China Reluctance on Reserve Cut Signals Inflation Concern (Bloomberg)

• Big Retailers Join Forces to Develop Mobile Wallet to Take on Google (WSJ) see also Visa and MasterCard Settle Lawsuit, but Merchants Aren’t Celebrating (NYT)

• In the Ordinary, Silicon Valley Is Finding the Next Big Thing (DealBook)

• Here’s an Omical Tale: Scientists Discover Spreading Suffix (WSJ)

• Thinking This iPad Mini Thing Even Througher (Daring Fireball) see also Happy 10th Birthday, Daring Fireball (The Atlantic)

• The rise of Brooklyn (USA Today)

• Economists Supporting Mitt Romney for President (Economists For Romney)

What are you reading?

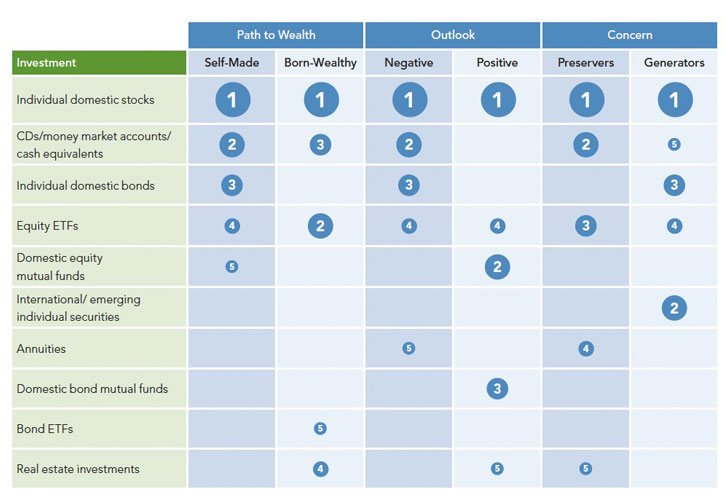

Millionaires Make A Move

Source: Barron’s

What's been said:

Discussions found on the web: